Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Merchant services exist to help businesses process credit card payments. You might know them by the name “credit card processors.”

Regardless of what you call them, it’s important to choose the right merchant service for your specific business if you want to take payments from customers.

I’ve reviewed the top six merchant services available today. These are all proven, popular products with reasonable fees.

They all do things a little differently, however, and serve particular types of businesses better than others.

Keep reading to find the one that’s going to fit with your situation. I’ll take an in-depth look at each of the six best merchant services, and conclude by walking you through the major criteria you need to consider as you evaluate your options.

#1. Square Review — The Best for Transparent Pricing/Fees

Pros:

- No monthly fee

- Transparent processing

- Free card reader

- Great added features

Cons:

- No ACH payment processing

- Higher fees than desired

Square is popular for its credit card processing and POS systems, but it offers much more. It hosts features such as the “Card on File” feature, allowing users to store customer card information that works great for repeat customers trying to accumulate loyalty points and rewards of that nature.

The processor also doesn’t have a monthly fee, and while Square’s features might not be as advanced as some of the other payment processors we’re talking about, for a POS without a monthly fee, you can’t beat the value.

You can accept payments online and in-person, though the transaction costs vary. For in-person sales, expect to pay 2.6% and $0.10 per transaction. For online transactions, it’ll cost you 2.9% and $0.30 per transaction. There are other instances, such as:

- Virtual terminal transactions

- Card-on-file transactions

- And card-not-present transactions

These will cost 3.5% and $0.15 per transaction.

If you have thousands of transactions every month, you can definitely find something cheaper than square.

But for a small business, the lack of monthly fees and price transparency makes it easier to budget than some of the other merchant services. Learn more.

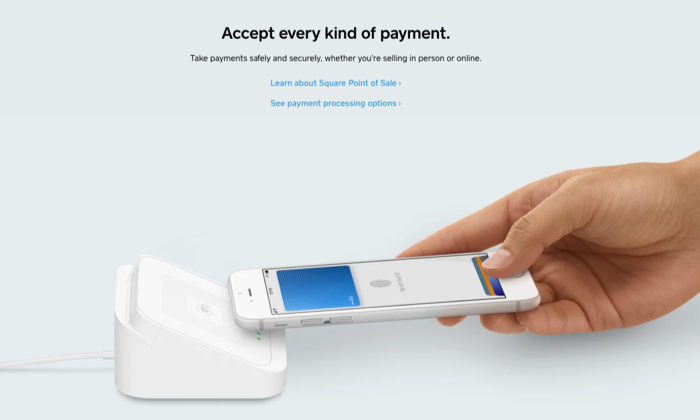

#2. Payment Depot Review — The Best for Established Businesses

Pros:

- No contract processing

- Competitive rates

- Easy to integrate online

Cons:

- Best for high-volume business

- Application process

Payment Depot uses a membership pricing model, which can save established businesses a lot of money.

New businesses that aren’t doing so much volume won’t see the benefit (and may actually wind up with higher charges than they would with other services), but if you are already handling a lot of transactions, Payment Depot can be a good choice.

Unlike other companies, the processing fees with Payment Depot’s membership pricing remain consistent and predictable no matter how much business you do.

Because Payment Depot isn’t of passing off credit card fees to the customer at an increased markup, you can wind up saving a ton of money. The more transactions you process, the more you save with the membership pricing.

Payment Depot accepts all major cards and contactless Apple Pay and Google Pay as well. You get next-day funding and integration with top POS systems as well as ecommerce platforms such as:

- Shopify

- Revel

- QuickBooks

- PrestaShop

- BigComemrce

- WooCommerce

I don’t think this is one of the best merchant services for small businesses because of how they structure their pricing. The transaction fees go down as you pay a higher monthly fee, and they seemingly force you to increase your plan because of strict processing limits.

Here’s a breakdown of their pricing:

Basic Plan

- Fee: $49

- Transaction Fee: $0.15

- Monthly Limit: $25,000

Popular Plan

- Fee: $79

- Transaction Fee: $0.10

- Monthly Limit: $75,000

Premier

- Fee: $99

- Transaction Fee: $0.07

- Monthly Limit: $150,000

Unlimited

- Fee: $199

- Transaction Fee: $0.05

- Monthly Limit: Unlimited

So, as you can see – if you’re doing high volume, it would make the most sense to upgrade to the most expensive plan for the lowest transaction fees.

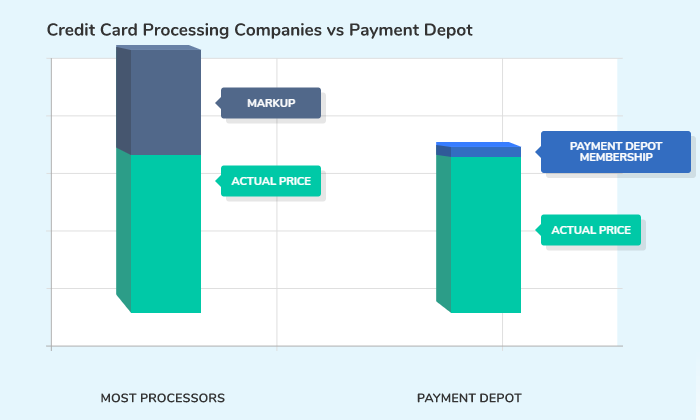

#3. Helcim Review — The Best for Small Business

Pros:

- Limited fees

- Fees based on volume

- Free online store software

Cons:

- Limited integrations

- $199 for the card reader

If you’re a small business owner, Helcim might appeal to you. With this service, you’re able to process credit and debit cards online and in person. You can also do some of the following: Set up recurring payments and send invoices.

With a Helcim card reader, you can accept all major cards, including Amex plus Google Pay, Apple Pay, and JCB.

Helcim does not have any contracts or cancellation fees, and they charge $0 in monthly fees.

Overall, Helcim is affordable but much more for in-person payments than they are online. Here’s a quick breakdown of their pricing structure, which is based on how much business you do each month:

Monthly Volume: $0 – $25,000

- In-Person: 0.3% + 8 cents (+ interchange)

- Online: 0.5% + 25 cents (+ interchange)

Monthly Volume: $25,001 – $50,000

- In-Person: 0.25% + 7 cents (+ interchange)

- Online: 0.45% + 20 cents (+ interchange)

Monthly Volume: $50,001 – $100,000

- In-Person: 0.2% + 7 cents (+ interchange)

- Online: 0.4% + 20 cents (+ interchange)

Monthly Volume: $100,001 – $250,000

- In-Person: 0.18% + 6 cents (+ interchange)

- Online: 0.35% + 15 cents (+ interchange)

Helcim offers nice features for those of you looking to integrate this payment gateway into your online store. You can add a checkout to your site for invoicing and customer registration while also accepting recurring subscriptions.

#4. Stax by Fattmerchant Review — The Best for Subscription-Based Businesses

Pros:

- Simple pricing

- Omni software

- A solid choice for subscription businesses

Cons:

- Higher monthly fees

- Transaction fees are relatively standard

Stax by Fattmerchant is set up a lot like many of the payment processors. As you increase your monthly fee, your transaction fees go down. They offer Omni, which is where you’ll do your invoicing, payments, and reporting. The service is incredibly user-friendly, great for beginners, and it comes included with your monthly fee.

While Stax is a great choice for budget-conscious business owners, it’s also a great option for subscription-based businesses. If you’re selling monthly coaching packages, agency services, or counseling, you’ll benefit from Stax’s structure.

The processor accepts all major cards, including ACH, invoicing, Text2Pay, and more. Same day funding is available, and you get a free iOS and Android POS app and Bluetooth card readers that you can use on the go.

Stax has extremely competitive prices that are easy to predict.

For businesses processing up to $5 million annually:

- Starting at $99/month

- Card-Present Fee: $0.08 + Interchange

- Card-Not-Present: $0.15 + Interchange

- ACH Processing Fee: 1% of transaction, up to $10

If your businesses processes more than $5 million annually, you’ll have to get in touch for a custom quote. The company also offers merchant services for SaaS Platforms, which may be your best bet if you’re in the subscription service game.

Stax has a higher monthly fee than some others, but the company says that is how they keep their transaction fees down. Learn more.

#5. Flagship Merchant Services Review — The Best for Great Customer Service

Pros:

- Dedicated account manager

- Free account setup

- Free card terminal (with fees)

Cons:

- Confusing ownership

- Little information regarding price

Flagship Merchant Services cut the tape in 2001 and was acquired by iPayment in 2012. Now, they primarily resell iPayment, so keep that in mind.

This company was one of the first to offer free account setup without any application or fees and real month-to-month contracts. They operate tens of thousands of merchants, and they have a strong reputation.

Since they’re not a direct processor, most of their merchant accounts are set up through iPayment. iPayment uses First Data as their processor, and it can get confusing trying to figure out who is processing what through what service.

For retailers, Flagship does offer a free credit card terminal, but you’re responsible for paying account fees and insurance on that terminal to keep it up and running.

For ecommerce, they offer either Authorize.net for processing and integration of an online cart onto your site.

One thing that was a little frustrating about Flagship is trying to find information on their rates. If you go to their website, you’ll see that you need to fill out a form to get any info about what they charge.

I’d like to see more transparency, but you may end up with a more catered package deal with this strategy.

My favorite feature is that you get a single line of contact with the company when you purchase a gateway; they act as account managers. If you ever have a problem, you contact that specific person, and this isn’t a feature I’ve ever seen with any other merchant service.

#6. Stripe Review — The Best for Online Payment Processing

Pros:

- Extremely customizable

- Reasonable pricing

- Great solution for online businesses

Cons:

- Complicated setup

- May require developers

If your business runs entirely online, Stripe is your best choice. It’s made specifically for ecommerce and internet business, and tons of startups and Fortune 500 companies trust Stripe.

The company offers sophisticated software and APIs that allow online store owners to customize their checkout experience. You can use the pre-built integrations to connect a Stripe checkout right away and then customize it as you go along.

That’s one of the main reasons why I love Stripe; it’s a payment processor that grows with you and allows you to change it as your business needs change.

With all of these features and moving parts comes complications. It’s not the easiest to set up, and if you plan on utilizing the many benefits of Stripe, you’ll likely need a developer to handle it for you.

Stripe offers a “pay as you go” strategy–there’s no monthly fee and transaction fees are transparent across the board.

- Online: 2.9% and $0.30

- In-Person: 2.7% and $0.05

- International: Add 1% per transaction

- ACH Direct: 0.8% maxed at $5.00 per transaction

- ACH Credit: $1.00 per transaction

You can use all major credit and debit cards plus ACH, WeChat Pay, Apple Pay, Google Pay, and much more. Expect to wait two business days for deposits or pay a one percent fee to get instant deposits.

Stripe integrates with WordPress, Magento, Squarespace, 3DCart, Zoho, Big Cartel, and more.

How to Choose The Best Merchant Services For You

Before we get into the reviews, let’s talk about how to determine what makes a good merchant service.

I’ve broken this down into three major areas:

- Processing rates/monthly fees

- Services

- Type of merchant services account

Let’s go through each of these criteria, one by one.

Processing Rates/Monthly Fees

It’s all about the money, and credit card processing is not as simple as you think. You have to weigh the pros and cons with each service; otherwise, you can end up paying way more than you planned.

We need to look at the processing rates first. With every merchant service, you pay a small fee each time a transaction is processed. It’s usually between 1 to 3%.

You’ll also pay monthly fees, which vary depending on the service you choose.

To get a lower processing rate, you usually have to pay a higher monthly fee.

So, if you’re processing a ton of payments, a merchant service with a high monthly fee and low processing rates can be a good option.

On the other side, if you’re not processing a lot of payments, having higher process rates won’t hurt you as much as a high monthly fee would.

There are also the rates that different credit cards like Visa and Mastercard charge. Merchant services like Toast let you choose between flat-rate and interchange processing rates.

With flat-rate, you pay a fixed amount for processing each month. With interchange, you pay whatever Visa or Mastercard charges plus a small fee to Toast.

Flat-rate processing is a predictable solution that works well for businesses that want to avoid big changes in their rates. That said, interchange pricing is generally more affordable.

Services

You want to look at what the payment processor offers in addition to credit card processing. Do they offer free POS systems, hardware, mobile payments, integrations, etc?

Some merchant services even offer consulting, customer loyalty features, and invoicing tools.

Sometimes the “extra benefits” you get from a merchant service provider can outweigh some of the negatives.

The Type of Merchant Service Account

There are two primary types of accounts, one is an aggregator (or middleman), and one is an ISO (or independent sales organization). Let’s compare the two and see why it’s important to understand the difference.

Aggregators

These are middlemen working in between the business and the bank, offering an easy payment processing solution for businesses. Square is an example of this, and while they make it easier, they usually have higher fees and transaction costs.

ISOs

Payment Depot is an example of an ISO, and while they usually have a more strict acceptance policy, they offer lower rates and user-friendly software compared to a direct processor.

Integration

How well will your current systems integrate with your new merchant service?

Whether your are selling online or in person, the product you choose should complement your current process or even enhance it.

Stripe offers a wide range of integrations for popular ecommerce platforms, which makes it a great choice for online stores. It also integrates with the best email autoresponders like MailChimp and GetResponse.

If you are already using these tools, Stripe integrations will make it easier to get set up and stay organized.

You shouldn’t have to redesign your daily workflow to accommodate a new merchant service, so find one that has the integrations to plug right into your business.

Summary

By this point, you should know which of these merchant services is right for you. They all have their pros and cons, and you should choose according to the type of business you own.

Let’s take a quick look back at my top picks:

- Square — Best for transparent pricing/fees

- Payment Depot — Best for established businesses

- Helcim — Best for small business

- Stax by Fattmerchant — Best for subscription-based Businesses

- Flagship Merchant Services — Best for great customer service

- Stripe — Best for online payment processing

If your business is already doing a lot of volume, I recommend exploring Payment Depot.

Square is an overall solid solution for all businesses, but the transaction fees are a bit high, and scalability is lacking.

I’m also a big fan of Helcim because they allow you to grow with your processor by increasing the monthly payment as your volume needs increase.

Regardless of which choice you make, keep the important factors in mind and choose carefully, so you don’t regret your decision down the road.

Did you miss our previous article...

https://consumernewsnetwork.com/technology-news/how-to-use-twitter-advanced-search-to-drive-100-more-leads