When you are thinking about travel insurance, you might be wondering, do I really need it? Is it really worth purchasing travel insurance? Well, it is not only about getting sick and requiring medical attention. Flights may be delayed or you may be forced to return home in the event of an emergency. Travel delays can cost you a fortune if you do not have travel insurance. In many cases, you lose the money you have already paid and have to pay for additional bookings.

If your luggage is lost, stolen or damaged, replacing all of its contents, including clothing, personal devices, and medications, can be very expensive. Travel insurance can help you cover some of the cost of these items.

Best TRAVEL INSURANCE Plans

SafetyWing – Our favorite pick

Best for nomads, (long/short-term) tourists, and remote workers regardless of their nationality.

Travel medical insurance for nomads but also short or long-term travelers.

Pros:

- Great fit for digital nomads, tourists, and remote workers regardless of their nationality. Ideal for long but also short-term trips!

- COVID-19 Coverage: As of August 1st, 2020, this insurance covers COVID-19 disease and works the same as any other illness and does not fall under any other policy exclusion or limitation.

- Included in your previous Safetywing plan?: If you are a new Safetywing new buyer, the COVID-19 coverage will be automatically part of your insurance plan. If not, we recommend you to upgrade your plan here. You can sign up for this insurance after your journey has already started.

- Price vs Age: Quite affordable considering the pandemic – These prices cover 4 weeks or 28 days with up to a maximum of 364 days after which you will need to repurchase.

- 10 to 39 years old US $40.04 (If you are not traveling in or to the United States)

- 10 to 39 years old US $73.08 (If you are traveling in or to the United States)

- 40 to 49 years old US $64.68 (If you are not traveling in or to the United States)

- 40 to 49 years old US $120.40 (If you are traveling in or to the United States)

- See prices for other age groups here.

- What about outdoor activities – Am I covered?: Safetywings covers more than 94 recreational activities including surfing, biking, hiking, and snowboarding.

- Do I have to pay insurance for my young children? 1 young child (aged 14 days to 10 years old) per adult, up to 2 per family are covered for free.

Cons:

- Safetywing only covers your medical expenses if you contract COVID-19 after your coverage starting date.

- This insurance does not cover citizens from Iran, Syria, North Korea or Cuba (or have Cuba as your citizenship).

Click here to learn more about this plan.

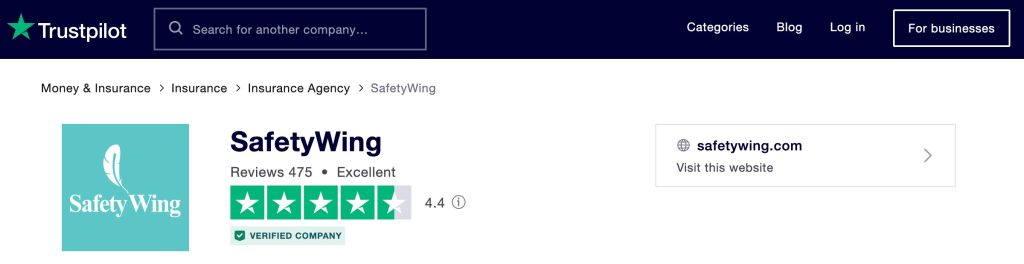

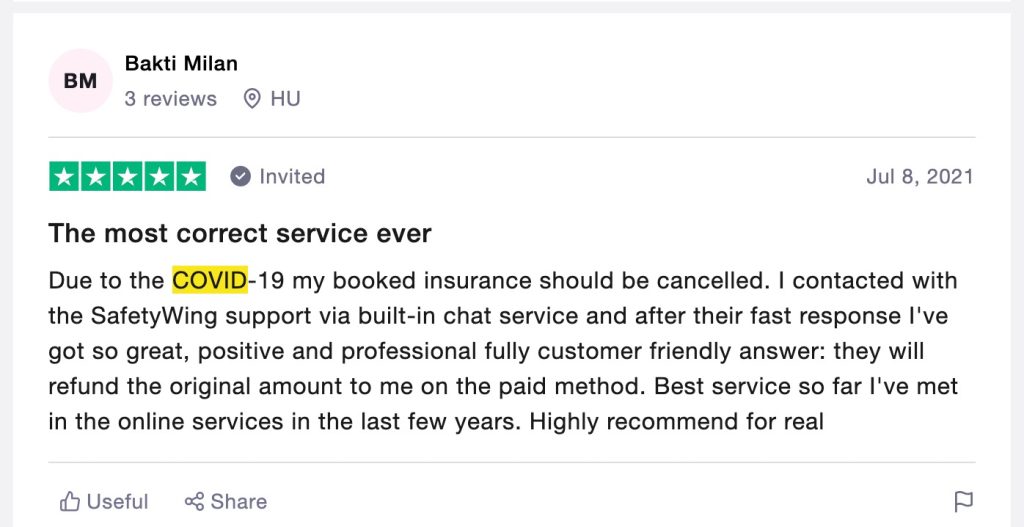

SafetyWing Travel Insurance Reviews on Trustpilot:

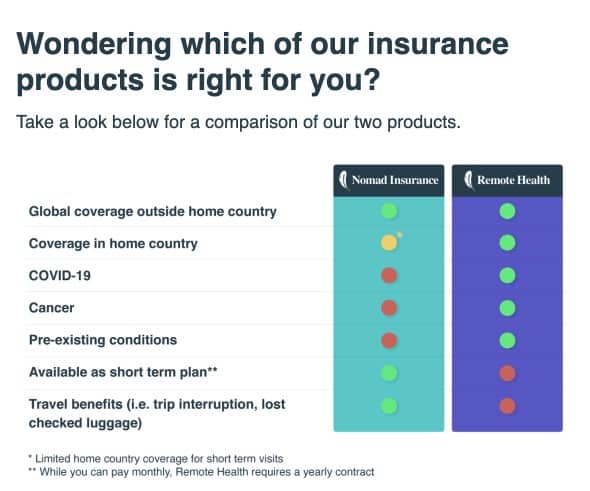

For long-term digital nomads, we also recommend checking their Remote Health insurance which is more pricey but covers pre-existing conditions or covers you also in your home country.

You might also be interested to check 8 digital nomad insurance plans comparison for 2022.

PassportCard Insurance

At PassportCard they constantly adapt and improve based on what the nomad community wants.

In a digital world, people don’t have to be limited by borders anymore. That’s why PassportCard give you access to quality healthcare. Anytime, anywhere since they are committed to provide a superior service experience.

Pros

Complete Flexibility

- You have the option of extending the duration of your plan.

- Cancel it or adjust your insurance coverage.

- Have you made any new plans? Depending on your needs, you can add additional protection.

The red card

- Use the Red Card to pay your medical bills.

- There’s no need to wait for repayment.

- Simply open the app, file a claim, and they will load money onto your card so you can pay any bills straight away.

Their App

- The app provides insurance services 24 hours a day, seven days a week.

- Find a doctor near you, load money onto your card, view your plan’s coverage benefits, change your information, and more.

- 24-hour emergency service

Other features

- Your policy can be acquired while you are already abroad.

- Monthly subscription – cancel or extend at any time

- Pay with the red card rather than your own money.

- International coverage starts at $59/month.

Plans

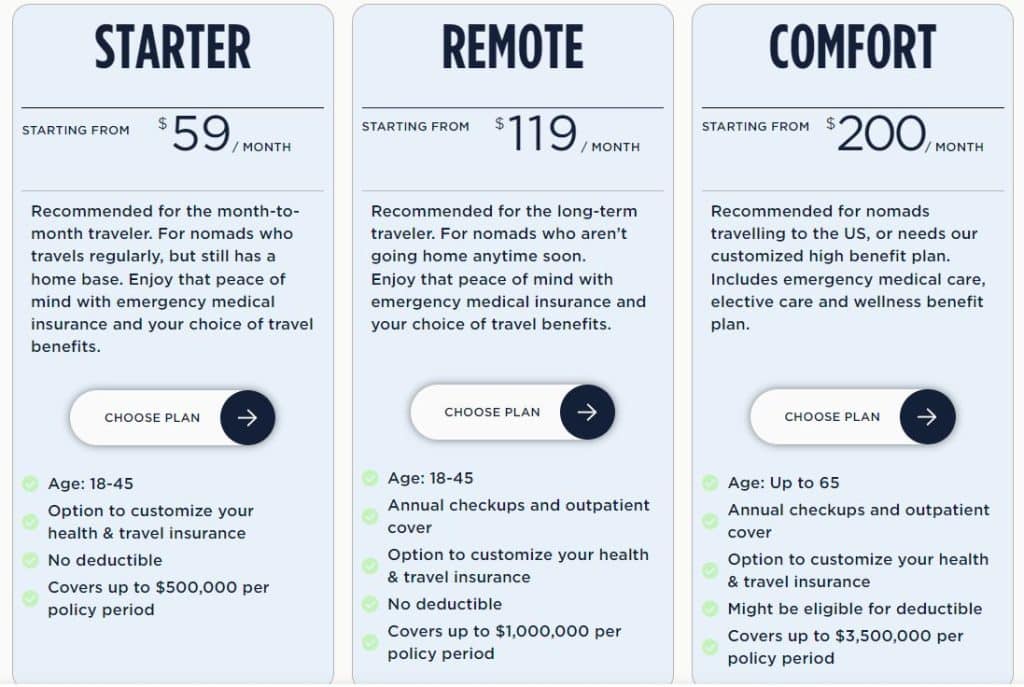

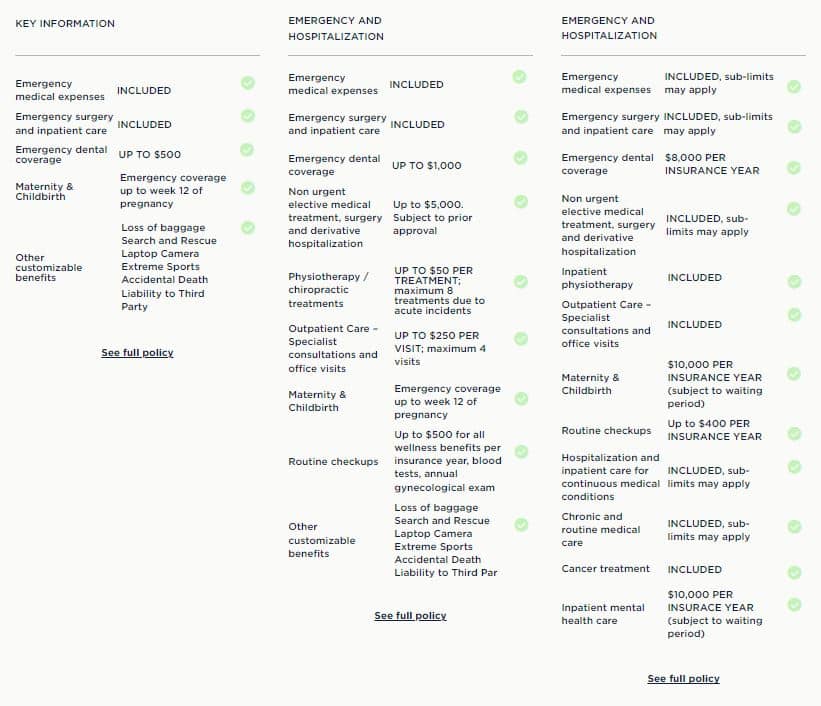

STARTER (starts at $59 / Month)

Traveling for less than six months? Enjoy emergency medical coverage as well as a variety of travel insurance advantages such as laptop and camera search and rescue, baggage loss, and extreme sports.

Up to $500,000 per policy period. Min. insurance period of 1 month.

REMOTE (Starts at 119 / Month)

Traveling for more than 6 months? Stay protected whether traveling or working outside of your native country.

Take emergency medical coverage, non-urgent elective medical treatment expert consultations, office visits, and wellness care with the Starter offer’s optional travel features.

Up to $1,000,000 per policy period. Min. insurance period of 1 month.

COMFORT (Starts at $200)

Traveling for more than 12 months?

If you are a professional globetrotter who spends years traveling, you need comprehensive international health insurance.

This includes emergency medical care, non-urgent elective medical treatment, specialist consultations and office visits, hospitalization for persistent conditions, chronic and routine medical care, and an excellent wellness benefits package.

Up to $3,500,000 per policy period.

Get your quote here!

Heymondo Travel Insurance

Best for travelers going on single trips who don’t want to commit to a long-term contract.

Most travel insurance companies offer protection for 30 days to 6 months. Heymondo not only offers protection for long stay plans, but also for single trips when you are traveling for work or tourism and know your departure and return dates.

Pros:

- Great fit for – Single or multiple-single-trip travelers

- Heymondo covers medical assistance from USD $100.000 up to USD $10.000.000 (conditions apply)

- Coverage limit – USD $ 250,000 or USD $ 500,000 depending on your plan

- Time of purchase: You can get it before or during your trip

- You don’t need to commit to a long-term contract

Other benefits:

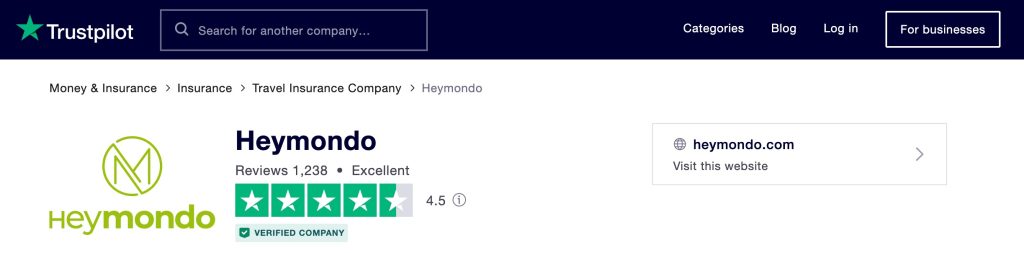

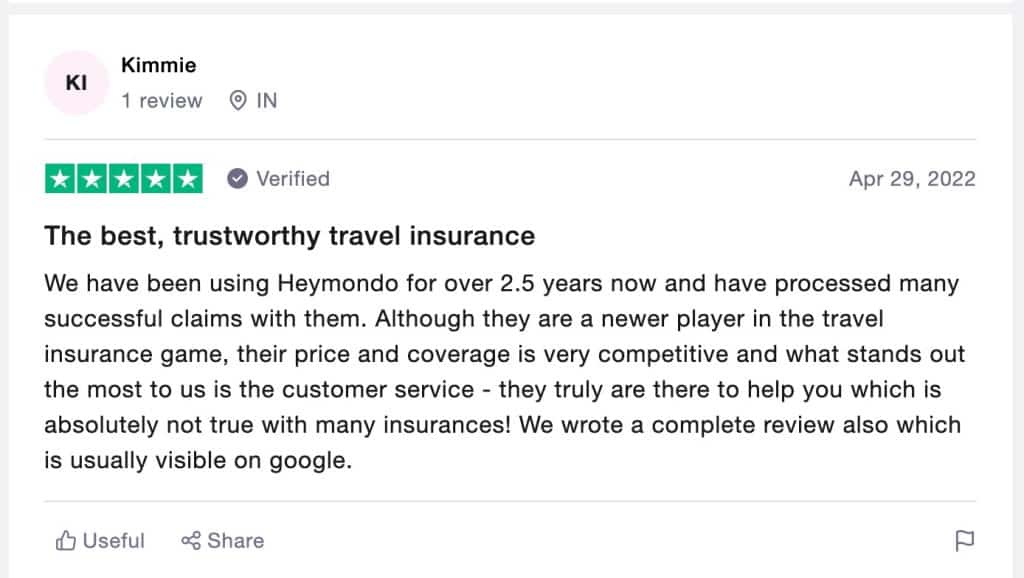

Heymondo Travel Insurance Reviews from Trustpilot

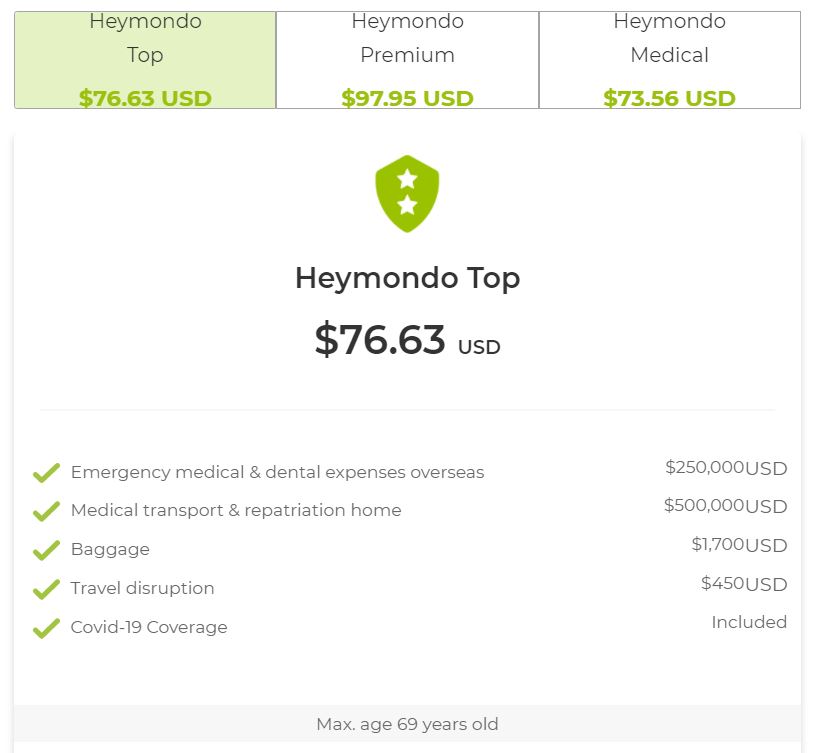

Both Heymondo Top and Heymondo Premium cover:

- Medical and dental emergencies overseas

- Medical transport and repatriation

- Baggage

- Travel disruption

- COVID-19 related treatments

Cons:

- It may be a little bit expensive. For a 2-week trip from the U.S. to Europe Heymondo Premium costs USD $ 97.95, Heymondo Top costs USD $ 76.63 and Heymondo medical costs USD $ 73,56.

- Heymondo medical doesn’t cover baggage loss or travel disruption.

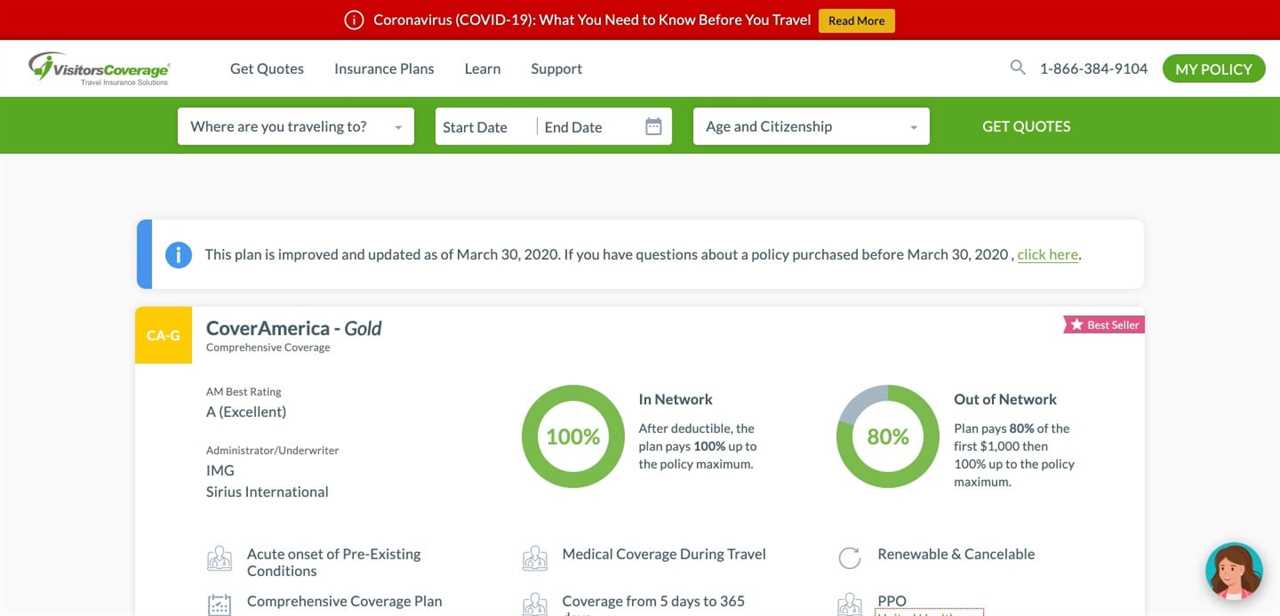

CoverAmerica-Gold, Travel Insurance for US by VisitorCoverage

Best for nomads, tourists, and remote workers visiting the US

CoverAmerica-Gold is a good choice for travelers visiting the U.S. who are NOT citizens or residents of that country. VisitorsCoverage offers plenty of insurance plans for needs of any kind of travel.

Pros

- Great fit for nomads, tourists, and remote workers visiting the United States

- COVID-19 Coverage: This plan covers COVID-19 as if it is any other medical condition. But it has to be purchased for a minimum of 30 days to be eligible for this benefit.

- Coverage limit? It may cover up to US1,000,000 (conditions apply).

Other benefits

- Covers acute onset of pre-existing conditions

- Loss of passport or travel documents

- Foreign excursions and cruise coverage around North America

- Emergency dental treatment & eye exam

- Missed connection benefit available during international travel to the U.S.

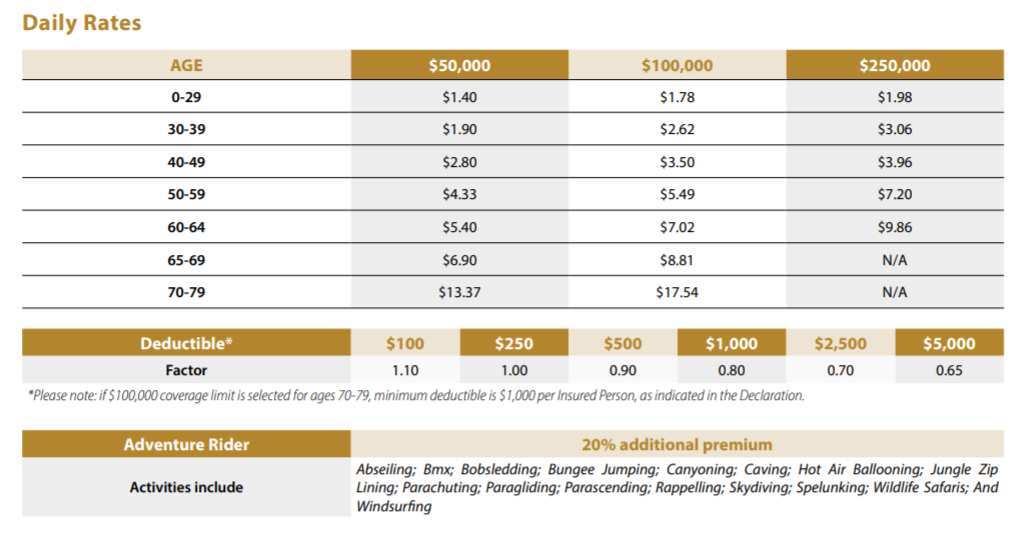

- Prices by age

Source: Cover America Gold Brochure

Cons:

- It’s NOT available for Americans, US Green Card Holders or long term visa holders, who stay in the USA permanently, and pay taxes in the USA.

- It does NOT cover citizens from Iran, Syria, US Virgin Islands, Ghana, Nigeria, and Sierra Leone.

Click here to learn more about this plan.

Travel Insurance for Canada by VisitorCoverage

Very similar package to the one mentioned above for traveling to the United States.

This plan is ideal for US citizens traveling to Canada but also visitors from other countries around the world.

Check more info about this plan here.

TRAVELEX INSURANCE SERVICES – FOR ALL TYPES OF TRIPS

Travelex insurance has built its travel portfolio considering not only regular travelers but also digital nomads and the new remote workers.

It has demonstrated excellent coverage on single trips, short luxury getaway weekends as well as long stays in foreign countries.

One of the features we like the most about Travelex Insurance Services is that this company allows people to customize their coverage according to the particulars of their travel needs. Another good characteristic is that even the basic plan gets you ALL the essentials. We find it a great fit for avid travelers because it brings flight-specific protection.

We have gathered some pros and cons so you can make an informed decision!

Pros:

- 24/7 Assistance with a travel concierge! – How many times have you missed great spots or haven’t accessed to benefits just because you did not know they existed? Well, Travelex travel assistance will serve you as travel concierge even in legal matters. Nobody knows when you can mess up with unknown rules in a foreign country.

- Similar to the previous one. In case of a medical emergency, Travelex will cover your emergency treatment and evacuation. It also includes a companion.

- In case you, or your companion passes away, this policy also covers the cost of transporting remains home.

- 98% of insurance claims are paid.

- In case you have to cancel or interrupt your trip for any of the covered reasons, you will get a reimbursement of the money you have already spent on your trip.

Cons:

Beware that some basic services may have an additional cost.

It’s not the cheapest one. A 22-year-old remote worker can pay from $ 324 and $491 for a 90-day trip.

World Nomads

First and foremost, World Nomads travel insurance has been endorsed by National Geographic, Eurail, International Volunteer HQ, and Lonely Planet. This may give you the first sneak peek of the quality of the service you are buying.

World Nomads insurance covers nomads, remote workers and adventure seekers from 150 countries. You can purchase short or long-term according to your travel needs.

Let’s talk about the basics in the middle of a pandemic; this insurance offers medical evacuation and 24-hour emergency assistance. This may be related to adventure activities you are engaging in, or in case you get sick with COVID in a country that may not have the medical facilities you are used to.

Pros:

- If you want to engage in extreme sports or very adventure activities, their Explorer program will cover you at every step.

- Extending your coverage service is at your fingertips. Once your coverage is over you can go online and easily extend it.

- Claims are handled very quickly.

- Its Explorer Policy is unique in the market.

Cons:

- It can be a bit expensive. But if you are a kind of adventure traveler, this is the right fit for you.

- World Nomads cover people in more than 150 countries; this also means that costs and coverages can vary depending on the area you are traveling to.

- It’s quite possible you need to have health insurance in your country of origin in order to get their add-on services.

- Scooter related accidents are mostly not covered.

Summary

World Nomads insurance gives you probably the best coverage if you like to engage in adventure activities at a fair price. The World Nomads standard plan, pretty much covers what others do. But in case you want an upgrade, this would be a great choice.

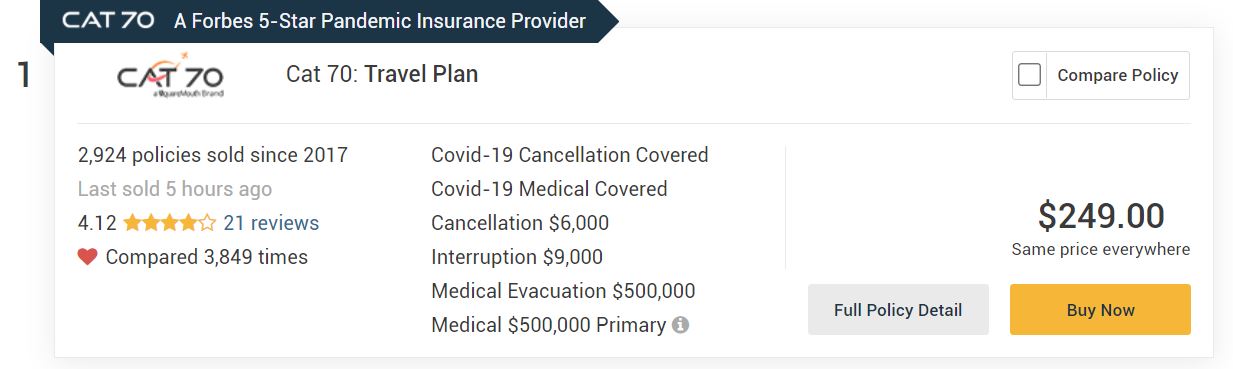

CAT 70 – Forbes 5-Star Pandemic Insurance Provider

Best for American, British and UEA citizens traveling and working overseas.

CAT 70 is a Forbes 5-Star Pandemic Insurance Provider for “the best coverage levels” across all of Forbes’ metrics. It has also been recognized nationally and internationally with 16 awards in 6 years.

Pros

- Great fit for American, British and UEA citizens traveling and working overseas.

- Prices are based on your trip cost – For a 1-month trip to Spain from the U.S. costing USD $6,000 total, CAT 70 offers USD $6,000 for cancelation, USD $9,000 for interruption and USD $500,000 for medical evacuation.

Most travel plans include benefits beyond trip cancellation and medical coverage. However, CAT 70 is one of the few insurance plans that offer extra benefits that resonate with pos-pandemic travel. The CAT 70 plan scores among the highest in our rankings because it also provides reimbursement for:

- Trip cancellation due to injuries, weather, hurricanes and terrorism

- Travel delay

- Missed connections

- Baggage and personal items

Cons

- This travel insurance is available for U.S., United Emirate Arabs, and United Kingdom citizens only.

Liaison Travel Plus*

Best for tourists, and remote workers visiting the U.S

Travel insurance for visitors to the U.S. and U.S. citizens traveling abroad.

Pros

- Great fit for nomads, tourists, and remote workers around the world.

- COVID-19 Coverage – This plan is designed to protect you while you navigate this “new normal” environment, even in the extreme case you get COVID-19 when traveling outside your home country.

Special COVID-19 coverage features

- Medical treatment for COVID-19 (the disease)

- SARS-Cov-2 (the virus), and any mutation or variation of SARS-CoV-2

- Travel assistance services (Including emergency medical evacuation)

- Repatriation

- Emergency medical reunion

- Return of children

- Return of mortal remains

- Local burial or cremation can apply

- Coverage limit? Up to 5,000,000

- Coverage Area – you can choose between two options:

- Worldwide coverage including the USA

- Worldwide coverage excluding the USA

- Any pre-existing conditions? – It covers them through the benefit for acute onset of pre-existing conditions.

- Price – It depends on several factors. You can buy from 5 to 364 days. Click here for prices.

Other traveler benefits

- Loss of checked baggage – US $50 per article, US $500 per occurrence

- Trip interruption US $5,000

- Travel delay US $100 per day, 2-day limit per occurrence

- Lost or stolen travel documents US $100

- Border entry protection (for non-United State residents traveling to the United States) US $500

- Personal liability US $50,000

Cons

- Travelers must be at least 14 days old and under 75 years to be covered by this plan

- It does not cover citizens from Iran, Nigeria, Cuba, Iran, Syria, Virgin Islands, Gambia, Ghana, Sierra Leone, and North Korea.

- It does not cover trips to Antarctica, Iran, Syria, Cuba, and North Korea.

Click here to learn more about this plan.

*(Administered by Seven Corners, Lloyd’s of London and Tramont Insurance Company)

AXA – Global Healthcare / Travel Insurance

Best for British citizens traveling and working overseas, ex-pats, and other EU citizens

This company provides medical care, routine checkups and lengthy hospital stays for travelers around the world.

Pros

- Great fit for British citizens traveling and working overseas, ex-pats and other U.E. citizens.

Special COVID-19 coverage features

- Your healthcare benefits will apply as normal if you’re diagnosed with the coronavirus.

- Out-patient care (if included it on your policy)

- Treatment in the UK (conditions apply)

- Evacuation and repatriation benefit (conditions apply)

- Coronavirus screening at airports (you are covered if your plan includes coverage for routine health checks)

Other benefits

- This insurance company allows choosing between long-term and short-term stays.

- Price – Depends on the countries you are visiting or living in.

Cons:

- You will not be covered for Coronavirus if you travel to a country against the advice of the Foreign and Commonwealth Office (FCO) for a leisure trip.

Click here for more info about insurance plans with this company

AXA Schengen Insurance

Best for travelers visiting the European Union or looking to obtain a Schengen visa.

Pros

- Great fit for travelers visiting the European Union and its Schengen associated countries or looking to obtain a Schengen visa.

- Budget-friendly – (from €20 for a stay of one week)

- AXA does not care about your age or nationality. At AXA everyone is equal!

Plans

Low Cost

- Only €0.99 per day

- Covers medical expenses of up to €30,000

- It has repatriation services

- COVID coverage under conditions*

- Meets requirements from the E.U

Europe Travel

Entitles an extended protection for you and your family

- Only €1.50 per day

- Covers medical expenses of up to €100,000

- Extended protection in all Schengen countries and Ireland

- Offers repatriation services

- COVID coverage under conditions*

Multi Trip Plan

- Only €298 per year

- Covers medical expenses of up to €100,000

- Extended protection in all Schengen countries and Ireland

- Offers repatriation services

- COVID coverage under conditions

Cons

The fine print on the COVID-19 coverage. The company specifically says “our insurance policies cover you when you travel in accordance with official recommendations issued by your home state’s foreign ministry or the government in the country of your destination.”

In an ever-changing Covid-19 it can be a bit difficult to catch up with all health regulations.

For instance, their policies will not cover you if you travel against the Foreign, Commonwealth and Development Office (FCDO) advice.

Countries covered by each plan:

AXA Schengen Low Cost insurance provides coverage for all Schengen Area member states: Germany, Austria, Belgium, Denmark, Spain, Estonia, Finland, France, Greece, Hungary, Italy, Iceland, Liechtenstein, Latvia, Lithuania, Luxembourg, Malta, Norway, Netherlands, Poland, Portugal, Czech Republic, Slovakia, Slovenia, Sweden, and Switzerland.

AXA Europe Travel and AXA Multi Trip covers all European Union member states : Germany, Austria, Belgium, Bulgaria, Cyprus, Croatia, Denmark, Spain, Estonia, Finland, France, Greece, Hungary, Italy, Ireland, Iceland, Liechtenstein, Latvia, Lithuania, Luxembourg, Malta, Norway, Netherlands, Poland, Portugal, Czech Republic, Romania, Slovakia, Slovenia, Sweden, and Switzerland.

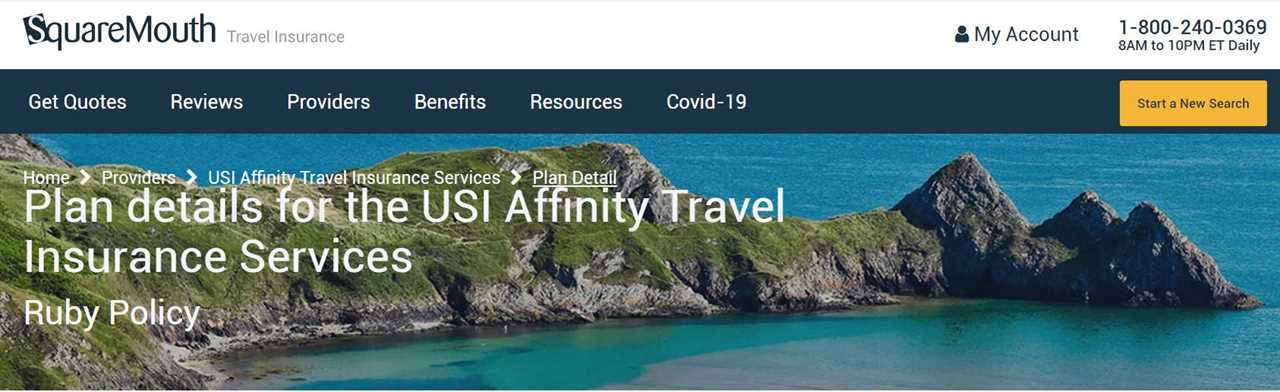

USI Affinity Travel Insurance Services – Ruby Policy

The USI Explorer Ruby plan offers high limits of primary medical expense and emergency medical evacuation coverage.

It also offers good “Trip Cancellation” coverage with optional “Cancel For Any Reason” (CFAR), which covers missed connections, plane ticket change fees, travel delay, and more.

Pros:

- The COVID medical coverage provided by the plan is primary, so you do not need to use your own health insurance plan first.

- In the event of unforeseen situations such as illness, injury, or death, it covers up to 100% of your travel.

- Trip interruption is also included. It pays for “unused, non-refundable travel arrangements prepaid to the travel supplier(s); or additional transportation charges; or returning air travel up to the cost of an economy trip, whichever is lower.”

- Travelers will be reimbursed when they must cancel their holidays due to illnesses, injury, or death of a companion.

- This policy also includes concierge services 24/7

Special COVID-19 Coverage:

- Cancel for Covid-19 Sickness: If a trip is canceled or interrupted due to the traveler contracting the virus, this plan can reimburse for prepaid and non-refundable trip payments.

- Medical Coverage for Covid-19: Includes charges for hospitalization and operating rooms use. This may also include expenses for a cruise ship cabin or a hotel room when they are recommended as a substitute for a hospital room.

Cons:

Ruby’s plan only covers “pre-existing conditions” when purchased within 14 days of trip deposit.

TravelSafe Insurance

Best for all types of American travelers with especially benefits for golfers

TravelSafe Insurance protection is specifically designed for American residents. Whether you’re traveling locally or abroad, this company can assist secure your trip, your valuables, and your adventure companions.

Pros

- Great fit for all types of American tourists with special perks for golf lovers

- Coverage limit? Available until up to US 500,0000 (conditions apply)

- Recommended by Forbes as one of the best health insurance plans for 2022.

Special COVID-19 coverage features

COVID-19 is treated the same as any other illness for the purposes of reimbursing losses incurred as a result of the illness, including death.

Depending on the plan, this can include but is not limited to:

- Trip Cancellation

- Trip Interruption

- Accident and Sickness Medical Expense

- Emergency Medical Evacuation/ Medical Repatriation/ Return of Remain

Other Health Coverage

- Waiver of the exclusion for pre-existing medical conditions

- Sickness and accidents a medical expenses (primary coverage)

- Emergency medical evacuation, medical repatriation, and return of remains

- Emergency evacuation for non-medical reasons

- 24-hour accidental death and dismemberment

- Optional air flight only accidental death and dismemberment

Other benefits – Coverage for Belongings

- Baggage & Personal Effects – Having to replace clothing and other personal articles for up to $2,500

- Baggage Delay – If your luggage is delayed for more than 12 hours, it is covered up to $250

- Optional Extended Personal Property Pac is available – Covers the expense of sports equipment rental if your checked sports equipment is lost, stolen, damaged, or delayed for more than 12 hours by a common carrier.

- Optional Rental Car Damage is available except for Missouri residents.

- 24 Hour Worldwide Assistance Services

Cons:

- Waiver of the Pre-Existing Medical Condition Exclusion does not include residents from Florida, Missouri, Kansas, Virginia, and Washington.

Safe Travels Voyager – Great for Seniors

The Safe Travels Voyager is best for travelers of all ages and from all countries, but it provides specific coverage for seniors over the age of 69 who can’t obtain comprehensive coverage from other companies.

This plan is for travelers who want to protect their vacation by having a high benefit limit. Safe Travels Voyager provides up to $100,000 in trip cancellation coverage as well as $250,000 in main medical coverage per person.

Pros:

- The plan includes a waiver for pre-existing medical conditions if the plan is acquired before to or with the final trip payment.

- This plan also includes $2,000 for possible lodging expenses.

- The Cancel for Any Reason (CFAR) option reimburses you for 75% of your trip costs.

- This plan meets the requirements for traveling to Costa Rica.

Estimate for two senior travelers going on a 3-week trip to Europe

(Coverage limits below are per person)

- Trip Cancellation $3,650

- Trip Interruption $5,475

- Financial Default 10 day wait if purchased within 21 days of Initial Trip Payment

- Terrorism in Itinerary City Foreign and U.S. Domestic

- Interrupt for Any Reason

- Cancel for Any Reason – 75% of non-refundable trip cost [requires purchase within 21 days of Initial Trip Payment and certain conditions are met] (+$566.12)

- Baggage Loss – $2,500, $300 per article limit, $500 combined max. for specified items

- Baggage Delay 8+ hours, $600 max.

- Travel Delay – 6+ hours, $150/day, $2,000 max.

- Vacation Rental Damage

- Medical

- Medical Limit $250,000

- Dental $750 included in Medical

- Pre-Existing Conditions

- Waiver If insurance purchased prior to or on the day of Final Trip Payment and certain conditions are met

- Lookback Period – 90 Days

- Accidental Death

- 24-Hr Full Coverage $25,000

- Evacuation

- Medical Evacuation $1,000,000

- Repatriation of Remains $1,000,000

- Additional Benefits

- Rental Car $35,000

- Included Benefits Pet Medical Expense – $250

- Missed Connection

Cons:

- The plan may be a bit expensive compared to others in the market. For a 21-day trip to Europe, two senior Americans would have to pay some $809.06.

Coverwise, Travel Insurance

Coverwise is the best choice for travelers visiting European countries including the United Kingdom.

Before you travel – They provide coverage in the event you become ill with COVID -19 and are unable to travel or need to quarantine.

During your travel – All policies cover medical claims due to COVID -19 if there was not an (FCDO) warning against the destination.

Coverage extends to reasonable additional transportation and/or lodging costs up to the standard of your original booking (e.g., full or half board, all-inclusive, bed and breakfast, self-catering room only, etc.

Pros

- One of the most affordable in the market

- Coverage of up to Eur 23,979,000 for medical expenses

Cons

- Higher missed departure benefit is available elsewhere but for the price is still generous

Allianz Global Assistance

Allianz Global Assistance is a comprehensive insurance coverage that protects your travel investment, reimburses the cost of medical emergencies and gives you 24/7 access to assistance services.

Pros:

- Trip cancelation: This travel insurance may reimburse you for planned, non-refundable travel expenses if you must cancel your trip for a covered reason.

- Medical emergencies: it can help you get quality care and reimburse you for covered medical expenses.

- Trip delay: you may be reimbursed for certain expenses, such as hotels and meals.

- Expert assistance and advice is available 24 hours a day, 7 days a week.

Special Covid-19 coverage

“Most of their plans now include an pandemic Coverage Endorsement, which adds epidemic-related covered reasons for certain benefits.”

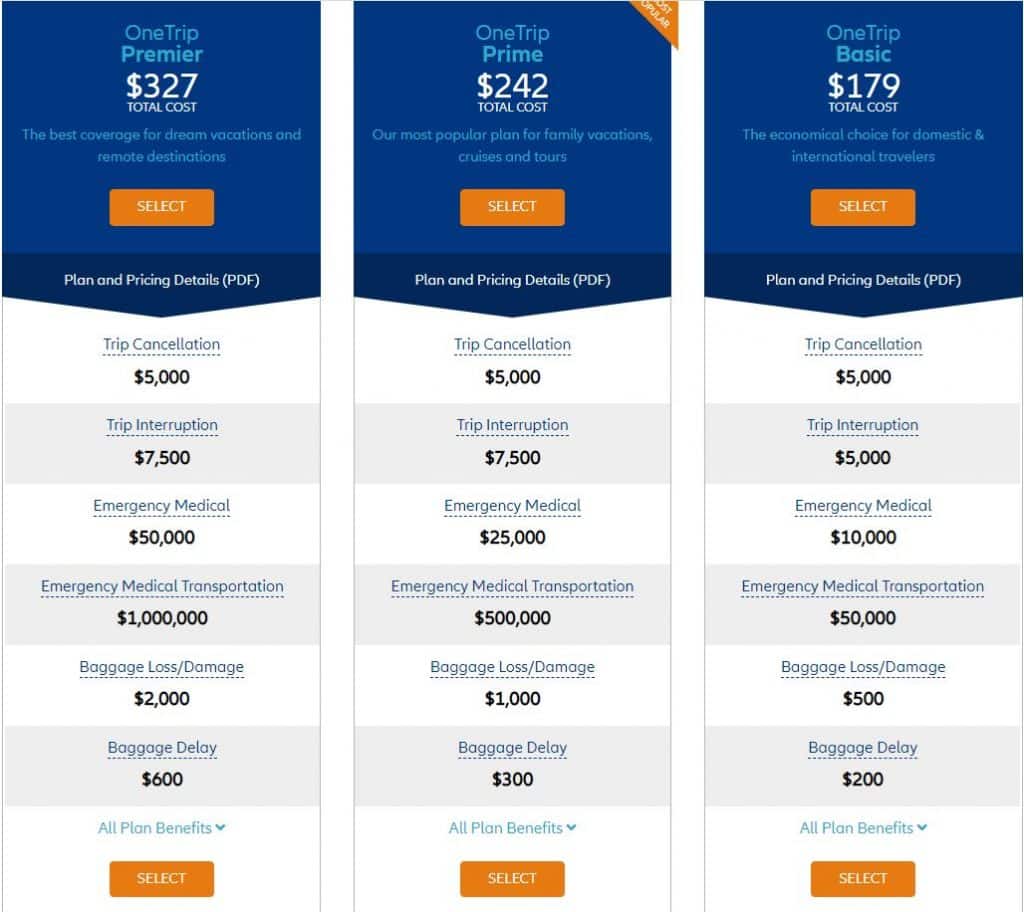

Consider one of these 3 awesome plans

OneTrip Basic: with up to $10,000 in trip cancelation and trip interruption insurance and up to $10,000 in emergency medical coverage, it’s a favorite among budget travelers.

OneTrip Prime covers things like trip cancelation/interruption, medical emergencies, emergency transportation and trip delays, among other things. When traveling with a parent or grandparent, children under 17 are covered for free.

OneTrip Premier offers the most comprehensive coverage for trips in faraway destinations.

Cons:

- Covid-19 benefits may vary by plan and location and are not offered in all states. Please see the Coverage Alert and COVID-19 FAQs for more information.

- It is slightly more costly than similar insurance plans on the market. But the coverage makes it worth it.

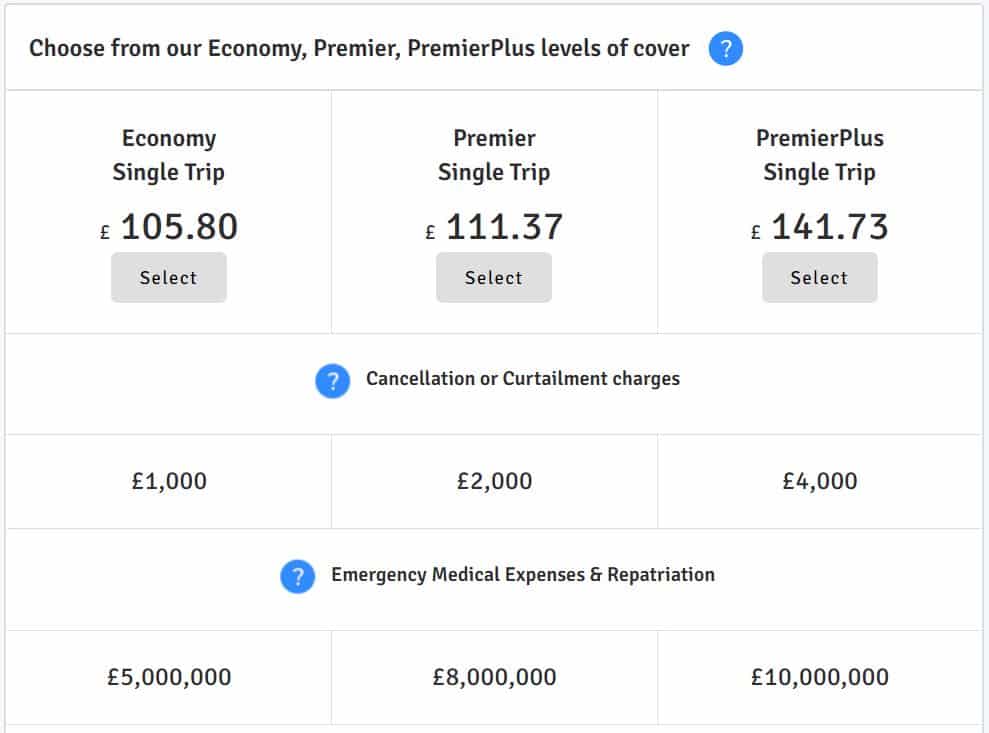

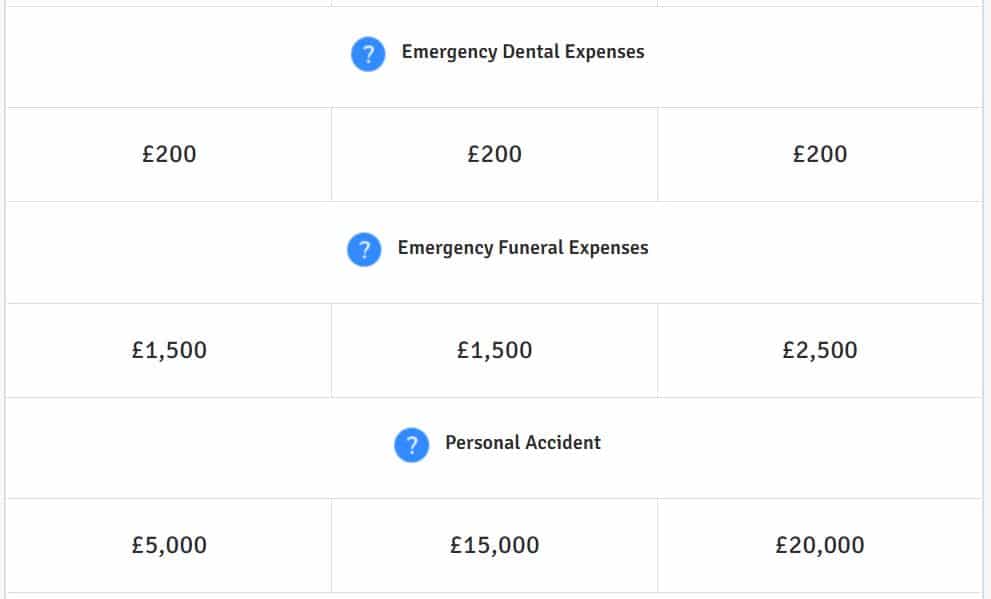

TravelTime Travel Insurance

TravelTime Travel Insurance specializes in Single Trip, Annual Multi-Trip, Winter Sports, and Backpacker travel insurance at a great price.

Their policies cover clients up to and including the age of 75, allowing you to conveniently and rapidly select and personalize your coverage to match your specific needs.

Coronavirus coverage

This low-cost insurance pays if you or someone listed on the policy becomes ill with Covid within 14 days of your scheduled departure date and must cancel your trip. It also reimburses up to £4,000 in cancelation costs against a £99 deductible.

If you contract the virus during your vacation, you will be reimbursed for emergency medical treatment related to Covid. Please note that this only applies if you have received all required Covid vaccinations (unless your medical records show that you are not eligible or exempt).

You will also be fully covered if you have to interrupt your vacation due to Covid and return to the UK.

Read the policy’s full terms and conditions.

Get your quote here!

COVID TRAVEL INSURANCE FAQs:

Yes, most of the insurance companies have a package that covers trip cancelation and one of the reasons can be due to COVID-19.

If covid testing is related to treatment or hospitalization, your insurance company will cover it. If testing is related to travel (as one of the requirements) to enter some country, it most likely won’t be covered.

Yes, if on your trip you will get sick and you will have to quarantine, your insurance will cover also your quarantine. Double-check with your insurance company.

Getting good COVID travel insurance can be tricky. Your insurance company may have told you that you are, but there are so many exceptions and “only-if” stipulations that you may actually not be covered at all.

We strongly recommend you upgrade or choose a new plan that was designed having into account the many ways in which COVID can sour your trip.

Travel insurance in most cases covers your quarantine unless quarantine extends the length of your trip and length of your insurance.

We hope you’ve liked this comparison of insurance that covers COVID! We hope you’ve found a suitable plan for your next adventure during these rough times!

Let us know in the comment below if you have any suggestions, ideas or feedback about insurance COVID coverage. We appreciate any kind of feedback.

The post 10 Best Health TRAVEL INSURANCE Plans for 2023 appeared first on Traveling Lifestyle.

------------------------------------------

By: Maria Valencia

Title: 10 Best Health TRAVEL INSURANCE Plans for 2023

Sourced From: www.travelinglifestyle.net/health-travel-insurance/

Published Date: Tue, 06 Dec 2022 20:32:10 +0000