The Senate’s top tax writer unveiled plans to create a special new tax on the uber wealthy that he hopes Democrats will use to help pay for their next big spending package.

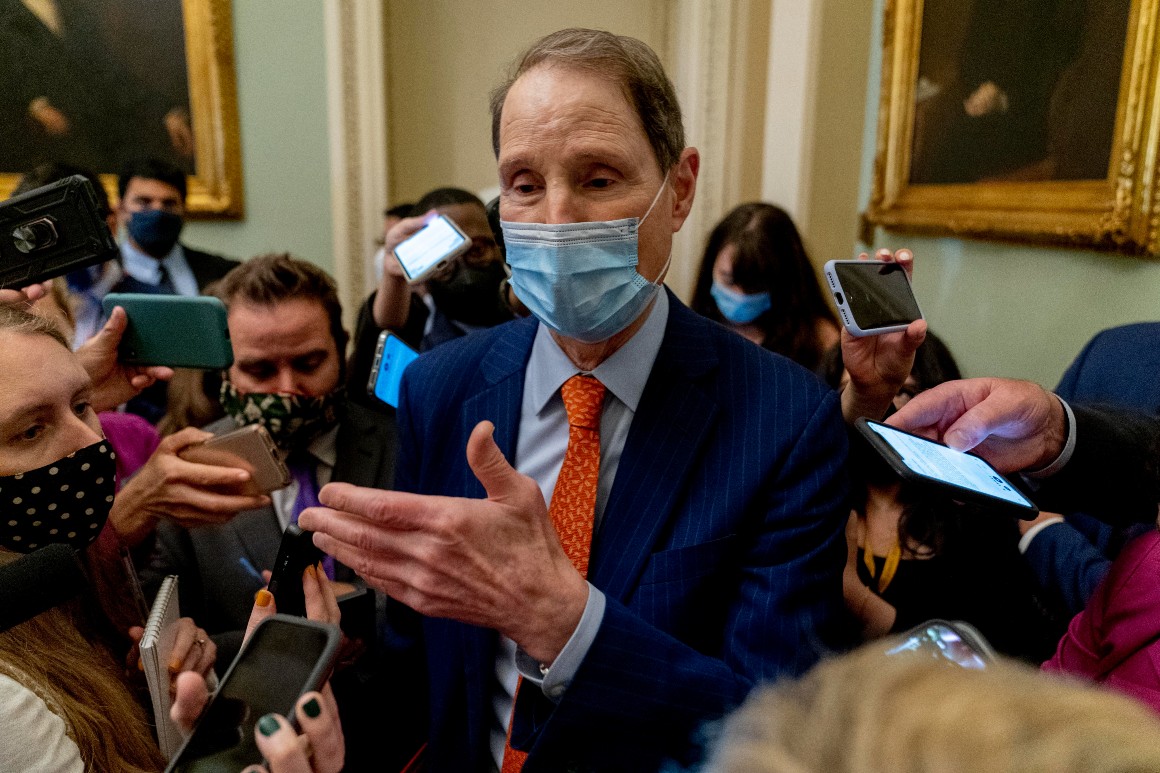

Finance Chair Ron Wyden (D-Ore.) wants to begin requiring people with more than $1 billion in assets, or who earn more than $100 million in three consecutive years, to begin paying capital gains taxes each year on the appreciation in value of their assets, regardless of whether they are sold.

Wyden figures it would hit around 700 people, and expects it to generate several hundred billion dollars, though Congress’s official scorekeepers have not yet put a number on the plan.

“We have a historic opportunity with the Billionaires Income Tax to restore fairness in our tax code, and fund critical investments in American families,” said Wyden. “The Billionaires Income Tax would ensure billionaires pay tax each year, just like working Americans.”

It would be a fundamental change in how the tax system operates, and open up a new revenue stream for the Treasury — one some liberals hope will eventually be extended to millionaires as well.

But it’s sure to be controversial.

Many House Democrats are already balking at the proposal, preferring a slate of more traditional tax increases approved last month by the Ways and Means Committee.

And the proposal, should it pass, would almost certainly be challenged in court.

The Constitution restricts so-called direct taxes, an antiquated term referring to levies imposed directly on someone that can’t be imposed on someone else. There’s a big exception for income taxes, thanks to the 16th Amendment, which allows Congress to tax earnings. The question with the billionaires tax will be whether it counts as an income tax.

The plan comes after Sen. Kyrsten Sinema (D-Ariz.) balked at fellow Democrats’ plans to finance their spending package with more traditional hikes on individuals and corporations, leaving Democrats scrambling to find other ways to cover their costs.

Wyden’s proposal would begin by imposing a one-time tax on all the gains that had built up before the tax had been created. So, under the proposal, Jeff Bezos would owe taxes on the appreciation of his unsold Amazon stock dating to its early days. He'd have five years to pay the bill.

After that, Wyden's plan would charge capital gains taxes on the subsequent annual appreciation, with different rules for different kinds of assets.

Stocks, bonds and other publicly traded assets, whose values are easily ascertained, would be assessed the levy each year. Harder-to-value assets like real estate or ownership stakes in privately held businesses would not be taxed until they are sold, but would then face an interest charge designed to approximate the tax people would have faced if they had been publicly traded assets.

They would be allowed to take losses against their gains, and carry them forward to future years to offset income. In certain circumstances, they could carry them back as well.

Wyden also has a phalanx of rules designed to prevent people from ducking the tax, for example, by stashing assets in trusts or Opportunity Zones or by renouncing their citizenship.

----------------------------------------

By: Brian Faler

Title: Wyden fills in details for 'Billionaires Income Tax'

Sourced From: www.politico.com/news/2021/10/27/billionaires-income-tax-details-wyden-517318

Published Date: Wed, 27 Oct 2021 04:00:45 EST