After decades of U.S. efforts to engage China with the prospect of greater development through trade, the era of cooperation is coming to a screeching halt.

The White House and Congress are quietly reshaping the American economic relationship with the world’s second-largest economic power, enacting a strategy to limit China’s technological development that breaks with decades of federal policy and represents the most aggressive American action yet to curtail Beijing’s economic and military rise.

The new federal rules, executive orders and pending legislation aimed at China’s high-tech sectors, which began this fall and will continue in 2023, are the culmination of years of debate spanning three administrations. Taken together, they represent an escalation of former President Donald Trump’s tariffs and trade disputes against Beijing that could ultimately do more to slow Chinese technological and economic development — and divide the two economies — than anything the 45th president did while in office.

“You really have seen a sea change in the way that they're looking at the relationship with China,” said Clete Willems, who helped design China economic policy in the Trump White House as Deputy Assistant to the President for International Economics and Deputy Director of the National Economic Council. “[The Biden] administration views Chinese indigenous innovation as a per se national security threat ... and that is a big leap from where we've ever been before.”

The new strategy, which the Biden administration internally calls its “protect agenda,” is being rolled out this fall and winter in a series of executive actions. In October, the Commerce Department issued new rules aimed at cutting off Chinese firms’ ability to manufacture advanced computer chips. They will soon be followed by an executive order creating new federal authority to regulate U.S. investments in China — the first time the federal government will exert such power over American industry – and an executive order to limit the ability of Chinese apps like TikTok to collect data from Americans.

Congress is participating as well, drafting its own, bipartisan versions of Chinese investment screening, potential rules on American capital flows into China, and restrictions on TikTok and other apps that hawks hope can be passed next Congress.

Those initiatives come on the heels of Biden’s “promote” agenda — using the government to promote American competitiveness. That involved the approval of hundreds of billions of dollars of subsidies for domestic manufacturing in the CHIPS for America Act and Inflation Reduction Act last summer, focused on breaking U.S. reliance on China, and new rules against U.S. companies working with Chinese chipmakers.

Taken together, the “protect” and “promote” agendas represent a fundamental rethinking in the American government’s approach to China’s technological advancement and, ultimately, its economic development. While American policymakers were previously content to manage China’s technological growth and make sure it stayed a few generations behind the U.S., security officials now seek to bring Beijing’s development – particularly in chips and computing, but soon in other sectors — closer to a standstill.

National security adviser Jake Sullivan, who has led the development of much of the protect agenda, previewed the actions in September. Previous U.S. policy, he noted, sought to maintain “relative advantages” over adversaries through a “‘sliding scale approach that said we need to stay only a couple of generations ahead.”

“That is not the strategic environment we are in today,” Sullivan said. “Given the foundational nature of certain technologies, such as advanced logic and memory chips, we must maintain as large of a lead as possible.”

That speech, little noted at the time, revealed a basic rethinking of how the U.S. government views the growth and development of China — one that American policymakers have been prepping for years.

“It’s not an exaggeration to say this is a Biden doctrine of technology policy toward China,” said Eric Sayers, a former staffer for the U.S. Pacific Command during the Trump administration. “More than an escalation, it’s a grand departure from a three-decade strategy.”

It’s also a departure the White House would rather downplay. The administration insists that its protect agenda is focused squarely on stalling the Chinese tech sector, and not aimed at halting China’s overall economic growth or “decoupling” the two economies more broadly.

“We are not seeking the decoupling of our economy from that of China’s,” Commerce Secretary Gina Raimondo, who is enacting key parts of the agenda, said in a late November address outlining the administration’s new tech policies. “We want to promote trade and investment in areas that do not threaten our core economic and national security interests or human rights values.”

But that attempt at a middle road between decoupling and unfettered economic engagement is under attack by China hawks and free traders alike.

Those who want a tougher stance toward Beijing point out that the total amount of trade between the nations boomed through the pandemic, feeding a record trade deficit between the countries. Those China hawks, including some Trump administration veterans, say that Beijing’s control over the Chinese economy is so complete that the only way to ensure that American commerce does assist Chinese military development is to push for less trade between the countries, particularly in high-tech and defense-related sectors.

“I think we have to start the process of strategic decoupling,” said Robert Lighthizer, Trump’s former trade chief and a longtime China hawk, who commended Biden’s recent tech actions against China but urged him to pursue broader efforts to reduce U.S. reliance on the Chinese economy.

“Once you decide [China’s] a foe, you have to start the process of stopping the shipment of hundreds of billions of dollars each year that they’re using to rebuild their military,” he said, referring to record trade deficits with China following the pandemic.

While the Biden administration rejects those calls rhetorically, it also acknowledges that the protect agenda will soon spread to other major sectors of the Chinese economy. In particular, Sullivan has highlighted biotechnology and clean energy as two industries where the U.S. must not let China take the lead. But White House policymakers say those actions will be “carefully tailored” to affect only high-end, strategic products, and not cut off everyday commerce.

“Clean tech, biotechnology — these are sectors that are poised for significant growth,” said a senior administration official, who spoke anonymously to detail administration policies. “But to suggest that we’re going to be controlling all technologies within those sectors is not the case. It will be focused on critical technologies and choke points within sectors.”

Even so, the administration official acknowledged that there might be “broader impacts from the rules” that degrade the competitiveness of large Chinese firms, similar to how the Trump administration undermined Chinese tech giant Huawei. “But we’ve always said,” the official stressed, “that the intention of the controls is focused on national security applications.”

Regardless of their assurances, the new scrutiny on U.S.-China commerce has free traders — now on the sidelines after decades of policymaking dominance — fearful of a gradual slide into a new Cold War stance against China, one where any cooperation between the nations could be assailed as assisting the ruling Communist Party.

“It’s become a second era of McCarthyism — sorry to use that word, but it applies,” said Rep. Stephanie Murphy (D-Fla.), a stalwart free trader leaving Congress at the end of the 2022. “Basically, no politician, Republican or Democrat, can be seen as soft on China, and so that pushes us in the direction of not [discussing] smart policy, but politics.”

Capitalist peace theory

The new initiatives to curtail Chinese tech firms represent a shift from the optimistic stance toward technological development that defined American policy for decades.

Since the end of the Cold War, the U.S. had largely treated development — whether technological or economic — largely as a good in itself. As poor nations absorbed investment from the industrialized world, the argument went, they would “move up the value chain,” developing more sophisticated industries. That would boost incomes, build middle-class citizens, and ultimately lead to democratic reforms and peace between trading partners.

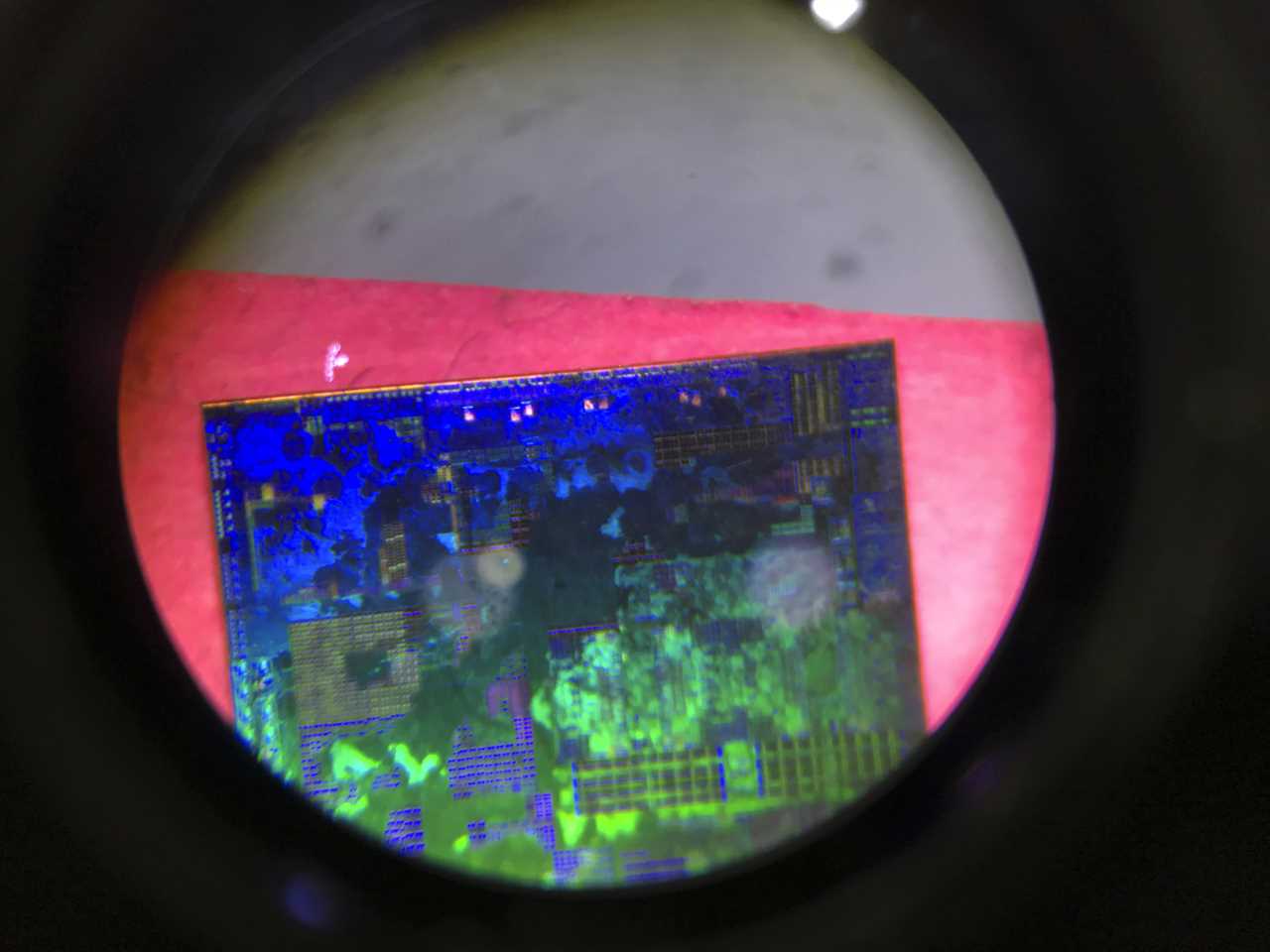

Those assumptions meant that the U.S. was content to let the development of many technologies — even some critical to national security, like semiconductors — move to other nations. If most high-end computer chips ended up being manufactured elsewhere, that was acceptable, or even desirable. Such was the logic of comparative advantage and the capitalist peace theory.

But China’s slide back to authoritarianism threw a wrench into that narrative.

During the second term of the Obama administration, some national security officials at the Pentagon and the National Security Council began to raise concerns about China “weaponizing” its economic development.

It was a “phase change in how the U.S. thinks about China,” Matthew Turpin, who was the NSC’s China Director from 2018 to 2019 after advising the Joint Chiefs of Staff under Obama, told an audience at the American Enterprise Institute this spring.

Since the end of the Cold War, the American approach to China had largely been “peace through trade,” he said, while the intelligence community “played a hedging role” for that strategy.

“It wasn't until sort of 2014 or 2015 the consensus around that began to weaken,” he said, as the U.S. government “largely began to assess that it didn't appear that political liberalization was happening [in China], and Beijing was very much developing economically.”

Even worse, the ruling Communist Party, national security officials believed, was developing a strategy to dominate critical industries of the future like rare earth minerals, semiconductors and solar panels. Beijing wasn’t exactly trying to hide it: In 2015, the Communist Party released its “Made in China 2025” strategy: massive state subsidies to 10 critical industrial sectors aimed at making Chinese firms globally dominant, and China’s domestic economy more self-reliant.

Such a strategy — coupled with aggressive lending to developing nations — would make much of the world reliant on Beijing for their economic growth and military development (not to mention the espionage opportunities it offered the Peoples’ Liberation Army). That got alarm bells ringing at the NSC.

Chinese leaders “have been quite clear where they want to be in the coming years in terms of gaining market share in all of the strategic technology sectors that will dominate the future of the world economy,” Liza Tobin, a former China director at the NSC from 2019 to 2021, said at the AEI event.

The first public evidence of the change in strategy came near the end of the Obama administration, when then-Commerce Secretary Penny Pritzker gave a speech calling semiconductors “imperative” to the American economy and saying, “we cannot afford to cede our leadership.” The national security veterans say the remarks, delivered only days before the 2016 election, were indicative of a deep reappraisal of China’s development — one later crystallized in a January 2017 report to outgoing President Obama titled “Ensuring Long Term U.S. Leadership in Semiconductors.”

“Going back to maybe around 2015 or 2016, I think there started to be a sea change between Western observers of Chinese technology development,” added Tobin, previously a CIA economic analyst, “[from] kind of dismissing them and saying ‘they can't really innovate, they're just copying,’ to starting to wake up to ‘oh, they're actually starting to achieve some of their ambitions.’”

Bureaucratic struggle

The growing China concerns among national security officials initially ran into pockets of opposition elsewhere in the U.S. government. Officials at Commerce, Treasury and even the State Department were largely bought into the free trade paradigm and were eager to further intertwine the world’s two largest economies, the national security veterans said, especially in emerging sectors like technology.

“The prevailing narrative underpinning policies at the time was that China presented significant export and revenue opportunities for businesses, so U.S. companies needed to be in that market and, consequently, tolerate China’s coercive technology transfer practices to maintain market access,” said Nazak Nikakhtar, former Assistant Secretary for Industry and Analysis at the Department of Commerce from 2018 to 2021.

“That narrative changed,” she added, “when the intelligence community, the White House, the Departments of Defense, Commerce and the U.S. Trade Representative began elevating the discussion through the identification of national security risks and human rights abuses.”

Throughout the end of the Obama administration and through Trump’s term, national security officials struggled to convince their colleagues in other agencies that commercial interests in the Chinese economy should, at least, be tempered by security considerations. While some investment was inevitable, and even beneficial, they argued the government must be more careful about just what the Chinese were getting from all this American money and know-how.

“Economic departments and agencies that for two decades focused on how to help the Chinese economy grow go through a really tough time” as the policy momentum changed, Turpin said, recalling the tension at the time.

“Everything that they had been doing in the relationship-focused in one direction,” he said, “And they're now being asked to do different things, and it creates friction within the bureaucracy in thinking about how to do that.”

In the Trump administration, the China hawks faced a quandary. While the president was willing to take on Beijing’s military, the former real estate developer was also enticed by the economic opportunity China’s economy presented. His cabinet choices reflected the split, with some China hardliners like Secretary of State Mike Pompeo and Deputy National Security Adviser Matt Pottinger facing off against the likes of Commerce Secretary Wilbur Ross, who was eager to boost commercial ties with China early in the administration.

The result was a split agenda for much of Trump’s term. While the national security state pushed the White House to crack down on Chinese tech firms and intellectual property theft, trade officials pushed Beijing to agree to historic commodity purchases as part of the so-called Phase One trade deal. And, as ever, Trump’s personal battles and rhetoric — like proclaiming trade wars "good" and "easy to win" — muddied the development of a cogent strategy.

The Trump team “spent a lot of time working ad hoc, whack-a-mole, lowest hanging fruit – pick your term – wherever we thought we could make progress,” said Ivan Kanapathy, who was on the NSC staff for China at the time.

One instance where conflict flared between economic and national security agencies was over efforts to ban wireless 5G chips and American software to the Chinese firm Huawei.

The Treasury was “very opposed” to a broad ban on Huawei, said Kanapathy, with the Commerce Department “not big fans either.”

In particular, the decision on whether to block the license for Google’s Android system on Huawei phones caused friction between agencies. National security officials argued that Commerce should prevent Huawei from using Google apps and other American programs — at the time, standard on Huawei phones outside China.

Blocking Google apps from Huawei “was really to go after their direct revenue streams,” said Kanapathy. “And in this, Treasury had a point. We weren’t only going after the threatening part of Huawei’s business. We also went after its overall financial health in an attempt to stop the bad behavior and deter others.”

In the end, though, the Trump White House took the side of the national security officials and banned Google from serving Huawei phones.

“That’s why Huawei phones aren’t sold outside of China anymore,” Kanapahty said. “Nobody wants an Android phone without the Google suite.”

The senior administration official for the Biden administration declined to say whether future actions — whether in semiconductors, biotech or clean energy — will target Chinese firms as aggressively as Trump went after Huawei. But the official noted that the Biden White House has not altered any of those Trump administration policies on Huawei.

“The stated target [with Huawei] was concern about 5G, and as is the case with a lot of export controls, there may be additional impacts when you do that, and you kind of have to accept those,” the Biden official said. “If it was the case that in the past that there was concern about collateral impacts, given the strategic situation, I think the consensus of the administration was that we needed to take these actions, given the new environment and the ways in which these technologies could be used.”

The ad-hoc policy battles continued until the Trump administration’s crystallizing moment: the Covid shock. Combined with Beijing’s repression of protests in Hong Kong, the pandemic’s shortages of masks and protective gear — not to mention internal White House concerns about Beijing’s complicity with Covid’s spread — seemed to confirm many of the concerns the security state had warned about since the Obama years.

The China hawks used that momentum — emphasized further by China’s brutal crackdown on dissent in Hong Kong — to push out a number of last-minute actions to limit China’s technological development before Trump left office, like putting firms like the Chinese National Offshore Oil Company on government blacklists and blocking American investments in a handful of firms affiliated with the Chinese military.

“That wasn’t so much about the technology,” Kanapathy said of the Covid and Hong Kong shocks. “It was more – wow. These guys are serious. They’re really a bunch of autocrats, and they’re really trying to challenge our way of life.”

Completing the pivot

Under Biden, that momentum to crack down on the Chinese economy has only strengthened. With the U.S. drawing down its Middle East involvement, Biden’s national security team could finally complete the “pivot to Asia” conceived during the Obama administration, rallying regional capitalist economies against China while trying to cut off Beijing’s advancement.

For national security staffers like Kanapathy, who stayed through the transition, Biden’s elevation of China hawks like National security adviser Jake Sullivan and his team’s willingness to keep Trump’s tariffs and trade restrictions in place was a “pleasant surprise.”

The policy outlook “really depended on who they brought in,” he said. “Some campaign advisers definitely wanted them to be softer, but I think the intelligence assessments and the pass-down they got [from the departing national security team] helped the hawkish Dems take charge.”

The new agenda was given another shot in the arm by Russia’s invasion of Ukraine, with Europe’s energy dependence on the Kremlin standing as a grim warning about China’s place in the global economy. If Putin could hold Europe hostage with its gas supplies, what could China do with its even broader dominance of other critical sectors?

“What we say to the Europeans is: if you think that being reliant on Russia for energy is dangerous, imagine digital dependence on China over the long term, both at the hardware level all the way up to the apps with TikTok and more,” Tobin, now a senior director at the Special Competitive Studies Project, told POLITICO this fall.

The solution, the Biden administration thought, was to pair a new push in American industrial policy with a stepped up campaign to not just compete with China, but contain its growth.

The first element was to initiate new forums to engage allies who felt burnt by Trump’s brash go-it-alone rhetoric, aiming to build an alliance of market-oriented nations that could strike back at Beijing’s economic practices. That was the idea behind the Indo-Pacific Economic Framework, the parallel economic discussions with Taiwan, and the Americas Partnership for Economic Prosperity, the administration’s economic initiative for the western hemisphere.

While each of those initiatives has been criticized for not discussing new market opportunities for U.S. firms – a typical trade objective for American administrations — the administration has defended them as a way to re-engage allies who had been insulted by Trump.

With those initiatives rolling, the administration and Democrats turned to “running faster” than the Chinese — outcompeting Beijing with a new industrial policy focused on ending reliance on Chinese firms.

The initiative would be stretched across two legislative packages — what came to be the CHIPS for America Act and the Inflation Reduction Act. The CHIPS bill, in the works since the Trump years, provides tens of billions of dollars in direct subsidies to produce microchips in the United States, aimed at breaking a reliance on foreign nations that fed a shortage of chips throughout 2022.

The other legislation, eventually named the Inflation Reduction Act, was a slimmed-down version of the Build Back Better package Democrats failed to pass the year before. While many of the social spending programs were dropped — like the high-profile Child Tax Credit — the initiative still included a rewrite of the tax code that would reward entire swaths of the clean energy industry for using American-sourced products, from steel to solar cells.

The progressive economists who helped craft the IRA’s tax incentives call them the biggest industrial policy since the New Deal. And they focus on many of the industrial sectors Beijing was already trying to dominate as part of its Made In China 2025 strategy. Combined with the CHIPS Act, the intent was clear — breaking reliance on China’s economy.

With the legislation passed, the administration felt it could begin the third part of Biden’s new China doctrine, the protect agenda: cracking down on China’s technological development.

In early October, the Commerce Department’s Bureau of Industry and Security took the most consequential act to date, issuing two new rules that blocked American firms from shipping high-end microchip manufacturing equipment to China and making it easier to crack down on foreign nations that do not follow suit.

Though they did not block foreign firms from exporting to China, the rules represent the strongest regulation yet of American tech firms outside the U.S. — and a new era of broader, more ambitious export controls.

“This is a transformational change in the theory and philosophy and policy toward export controls,” said Kevin Wolf, a former Assistant Secretary of Commerce for Export Administration at BIS.

Historically, export controls were used to prevent the trade of items that went into weapons of mass destruction and the most harmful conventional military goods, Wolf said. But this new set of controls goes further, targeting microchips that could be used in weapons, the machines used to make them, and the personnel that service the factories. And the rules were also coupled with legislative action – a provision in the CHIPS bill blocked tech firms that receive its subsidies from building advanced chip factories in China for a decade.

“It's the use of export controls as a strategic tool, as opposed to a tool that is narrowly tied to non-proliferation objectives,” Wolf said.

Escalation plans

The administration has been clear that Washington’s campaign against Chinese development won’t stop at chips and export controls.

In his September speech, Sullivan outlined three broad sectors where the administration would try to stall Chinese development: computing (including chips, quantum computing and artificial intelligence), biotechnology and biomanufacturing, and clean energy tech.

“That is not to say that other technologies initiatives are inconsequential — far from it,” Sullivan said. “But computing-related technologies, biotech, and clean tech are truly ‘force multipliers’ throughout the tech ecosystem, and leadership in each of these is a national security imperative.”

But the White House and congressional leaders will have to find new ways to slow Chinese development in those sectors. While advanced chips typically need at least some American software or machines to produce, making them vulnerable to U.S. export controls, no such Chinese reliance on America exists for clean energy or biotechnologies.

“The nature of the tools that we use to go after biotech to go after clean energy are unlikely to look the same,” Willems said. “Export controls don’t really work for clean energy, because we don’t have the same technological leadership, so us controlling technology to China isn’t going to inhibit their innovation. So, they’re likely to tackle that problem in different ways.”

The upcoming executive order targeting American investment in China could be one way to check American funding and support for Beijing’s most prized industries, Willems and others said. But the scope of that order is still in question, and it remains unclear which sectors will be covered by new investment regulation, and whether the government will stop at foreign direct investment and joint ventures with Chinese firms, or apply rules to broader capital flows into China, like American banks and financial institutions investing in state-run firms.

“What outbound investment screening is intended to do is to say, if you can't send a certain technology to China, you shouldn't be funding the development of that very same technology in China,” Willems said. “And so I see a strong parallel between the way that outbound investment mechanism would work and [the chip rule]. They are both aiming at the same objective, which is that the U.S. shouldn't help Chinese indigenous innovation.”

The plan to limit data collection from Chinese apps like TikTok is even murkier. While national security veterans have warned that Beijing could use personal data from American app users for espionage or influence campaigns, the administration has to balance those concerns with the potential for political blowback if the popular video app is altered or shut down. Such a move would bring the China tech conflict into the everyday lives of millions of Americans, and Trump’s threats to shut the app sparked a fierce backlash directed at the administration and congressional offices.

Outside of executive orders, Biden could also dust off Trump’s tariff playbook to hit Beijing’s most prized firms. Since last year, the administration has considered a plan to alter Trump’s duties by lowering tariffs on some consumer goods like bicycles and increasing them on Beijing’s favored industries like clean tech. That plan has sat idle for months, but some industry officials believe a version of it is still likely to be applied once the U.S. Trade Representative’s ongoing review of Trump’s tariffs concludes next year. The deadline for comments in that probe is Jan. 17, but USTR has given no schedule for its decision after that.

The legislative outlook is equally unclear. Senate sponsors of the outbound investment bill — the National Critical Capabilities Defense Act — have tried unsuccessfully to attach their language to the CHIPS Act and the yearly defense spending bill in years past. Now, the Senate Banking Committee has reopened hearings on the bill with the hopes of finalizing it next session.

That could embolden the China hawks, since Banking Ranking Member Pat Toomey — an ardent opponent of the bill — will be retired by then. But it will also mean contending with the priorities of an incoming Republican House majority, which is expected to be largely receptive to the concept of regulating investments in China, but will want to put its own stamp on the efforts.

“We have an approach that we will present next Congress in clear form on our capital markets and our approach to competition with China,” Rep. Patrick McHenry (R-NC), who is likely to chair the House Financial Services Committee, said on Capitol Hill in November. “There have been great conversations across different committees in this Congress and last about our approach, but we'll engage in a more fulsome way in the next Congress.”

Some China hawks are concerned about McHenry, who is seen as closer to Wall Street than the outgoing committee Chair Maxine Waters (D-Calif.), and a new Republican majority they fear could weaken investment screening at the behest of American financial firms.

“I worry what the House could do” on Chinese investment screening, Sen. Bob Casey (D-Penn.), a sponsor of the Senate’s outbound investment bill, said on Capitol Hill in November.

Free traders have the opposite concern. As the Biden administration and Congress try to decrease exposure to the Chinese economy, lawmakers like Murphy warn that large American corporations could be at a disadvantage to firms in allied nations — particularly if they don’t follow Washington’s lead.

“If a U.S. company isn’t making as much profit as its competitors are, it’s gonna be really hard for it to … make bigger investments and out-innovate the Chinese,” she said, adding that the government’s push to subsidize chipmakers and other critical firms has perils in itself.

“The industrial policy, as we saw most recently with the CHIPS bill … relies on government to pick winners and losers, and it takes only one Solyndra to cause a real problem with our industrial policy,” she said, referencing the failed solar company that bedeviled the Obama administration’s clean energy efforts. “And so it’s a perilous time, and a perilous strategy that requires everything to go right.”

The decoupling conundrum

Murphy’s concerns point to a deeper question facing Biden and Congress in the new year — just how far to drive an economic wedge between the two economies.

While all agree that the administration has escalated U.S. action against China’s tech sector, there are those who want the moves to go further — and who criticize the administration for not already upping the stakes.

In issuing the chip rules, the Commerce Department let some chip firms in allied nations off the hook. Even though they use software from American firms, making them subject to U.S. export controls, the administration decided not to force firms in the Netherlands and Japan to stop shipping chip-making equipment to China.

The concern, the administration said at the time, was that if Biden included Dutch and Japanese firms in the tech blockade, they would simply program out the American software, continuing to sell chip-making machines to China while depriving U.S. firms of their business.

“We obviously don't have an interest in controlling technology made by U.S. companies that could be immediately backfilled by foreign competitors,” a senior administration official told reporters when the chip rules were issued, “which would simply see market share loss by U.S. firms and then PRC getting the same capabilities.”

Instead, the Biden administration said it expects allies to follow suit on their own, voluntarily issuing similar export controls that would stop their firms from enabling the Chinese chip-making sector. A deal to do so was close at hand, BIS head Alan Estevez told an industry event in late October, and should be completed by the end of the year.

But the path to that deal has been rocky, with the Dutch and Japanese making clear that they are not likely simply to follow Washington’s direction on export controls. Adding to the tension: mounting EU anger toward the industrial policies in the Inflation Reduction Act, which benefit American electric vehicle companies over European automakers.

That’s led some China hawks to say that the administration erred by not including the Dutch and Japanese firms in the first place.

“We really brought a knife to a gunfight” with the new BIS export controls, said Nikakhtar, who pushed for a more aggressive approach to China during her time at Commerce. “Why pressure [the foreign governments] when you can make it illegal?”

Even if the Biden administration can reach a chip control deal with its allies, similar issues are likely to arise as the U.S. government moves beyond the semiconductor sectors and seeks to stall or outpace China’s development in other critical sectors like biotech and clean energy. In each case, EU members will have to choose whether they continue to allow their companies to sell sensitive tech to the Chinese, or agree to follow American blockades.

“At some point, we have got to tell the Europeans that you’re either on our side or the other side,” said Lighthizer, who often ruffled feathers in Brussels during Trump’s tenure. “Europe wants to be somewhere between the two of us, and therefore they'll be resistant if they can make a buck.”

The Europeans say that Biden’s focus on rebuilding American manufacturing — sometimes at Europe’s expense — is making cooperation even harder. EU members are fuming that Biden’s Inflation Reduction Act cuts their domestic automakers out of hundreds of billions of dollars in electric vehicle subsidies by stipulating that final assembly must be done in North America. After Biden’s promises of a post-Trump reconciliation with allies, Brussels is feeling betrayed by the action.

The new subsidies, combined with unilateral American actions on Chinese tech, “make Europe consider the U.S. as a country of concern, not too distant from China,” said Hosuk Lee-Makiyama, a former EU and Swedish representative at the World Trade Organization.

At the core of the disagreement is a conundrum — just how far to push the economic decoupling from China. Some, like Lighthizer, say that the U.S. should look beyond limiting China’s development in a handful of sectors, and try to reduce the overall trade deficit with the world’s second-largest economy.

“Smart guys tend to get caught up in the technology, because it's so technical, and so futuristic and all that, but [trade in goods like] t-shirts is bad, too,” said Lighthizer. The trade deficit, he has long argued, “also builds up their technology, builds up their military and their spy network.”

“In other words, we’re funding all this horrible stuff,” he said.

That push for broader decoupling could gain steam with Republican China hawks in the next Congress, as they look for ways to paint the president as soft on Beijing. But for now, the White House’s team and its recent veterans are pushing back on that rhetoric, saying they will aim to balance the new tech conflict with China while retaining commercial ties.

“The general message we're trying to get across is that I think the conversation about ‘decoupling’ is a little bit 2019,” Tobin said. “We need to be talking about selective disentanglement and being more nuanced, going issue-by-issue, finding common-sense steps to protect our interests while still allowing for the idea that economic and trade cooperation can bring benefits.”

----------------------------------------

By: Gavin Bade

Title: Welcome to the real U.S.-China trade war

Sourced From: www.politico.com/news/2022/12/26/china-trade-tech-00072232

Published Date: Mon, 26 Dec 2022 07:00:00 EST