When 30-year-old crypto billionaire Sam Bankman-Fried appeared in the Bahamas’ Magistrates’ Court to answer to eight counts of conspiracy, money laundering and other crimes, he looked like a much older person — and it wasn’t simply that the prospect of 115 years in prison had aged him.

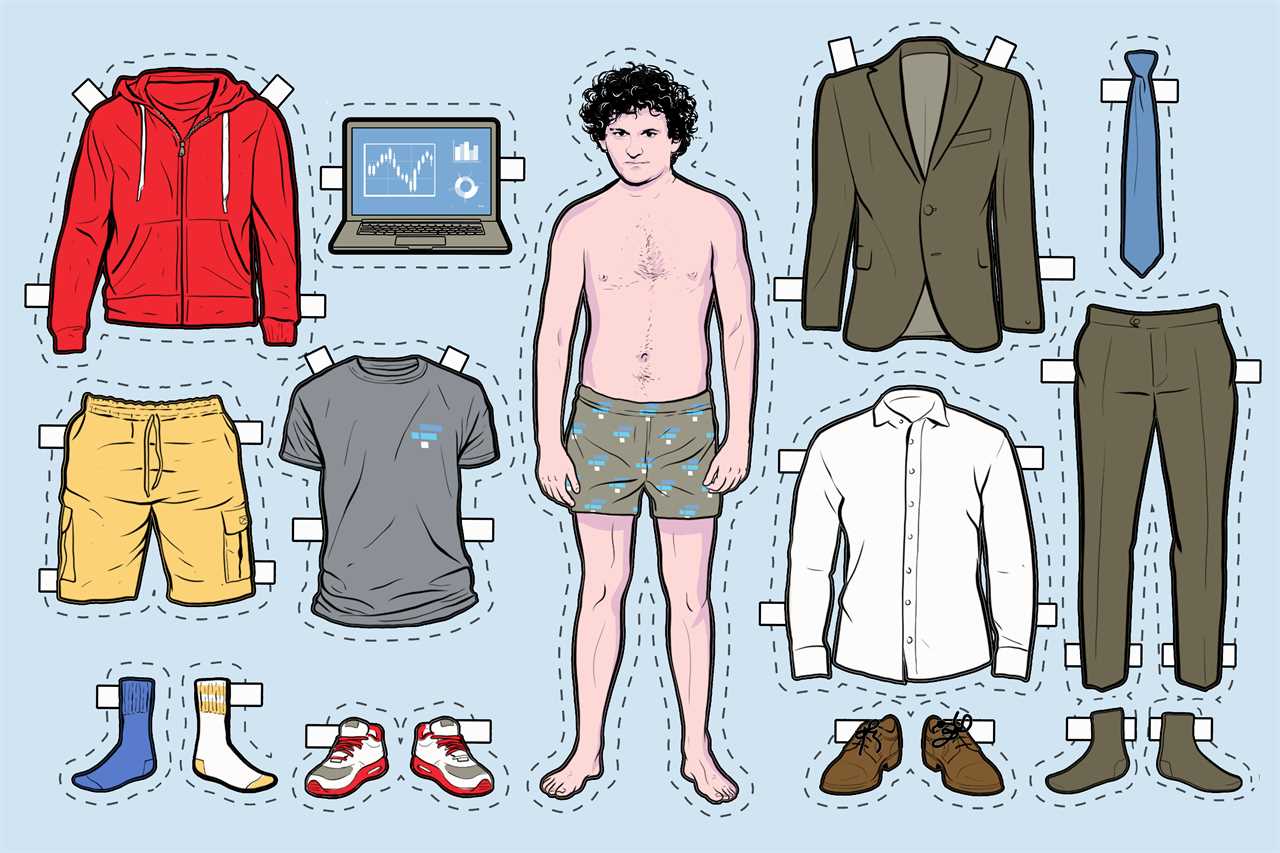

Gone were his trademark long T-shirt and shorts. His shoes were tied. Surrounded by federal agents and lawyers, with his wild rat’s nest of hair more neatly coiffed, he looked like a garden variety Wall Street defendant facing down charges of being a tax cheat.

And that was the point. For Bankman-Fried, looks have always told his story.

During his time in the public eye, SBF (as he is widely known) donned a regular uniform of sneakers, long white socks, shorts that went below his knees and a long T-shirt that sometimes seemed barely laundered. He let his hair grow in every direction. This dishevelment seemed curated to advertise his youth and irreverence.

The aesthetic sent a message about his crypto business, intended to reassure jittery investors: This is a new generation that invests its money in a different way. While technically a Millennial, SBF cultivated an appearance of Gen-Z or youthful nonchalance, while surrounding himself with younger colleagues and hangers-on. For older people terrified by the idea of an unmoored currency, it may have been strangely reassuring — Bankman-Fried looked so different, and yet was accruing wealth so quickly, that he must have known something about the economy of the future.

“It’s a deliberate cultivated image — ‘I’m so driven, I’m so passionate, I’m so obsessive, this company is my life and I don’t have time to groom or attire myself in the way a traditional businessperson would,’” said Rachel Tashjian, the fashion news director at Harper’s Bazaar.

That is, until his entire brand — from supporting political candidates who would advance his concept of a better future to suggesting that it’s either get on the crypto bus or get left behind — was discredited in a single day. His fall from grace was so precipitous that he also imperiled the entire artifice on which he built his brand: the power of the tech influencer economy.

And for would-be influencers of his generation — who wear their images on their sleeves, whether as fellow models of dishevelment-as-symbol-of-disruption or something far more glitzy — the question must be asked: Can they avoid being trapped in his undertow?

In December of 2021, less than two years after Bankman-Fried founded the cryptocurrency exchange FTX and four after he created its sister trading firm Alameda Research, he went to Congress to talk shop: regulation in the crypto industry.

By that point, his star was burning bright well beyond the crypto space: as a deep-pocketed Democratic donor, an evangelist for effective altruism and an entertaining Twitter follow. Throughout his ascent into the public eye, Bankman-Fried also burnished a reputation as an idiosyncratic personality, famous for playing the online game League of Legends during pitch meetings and sleeping on beanbags. He was committed enough to this presentation that it was a legitimate question whether he would show up to his Congressional testimony wearing something other than his trademark T-shirt and shorts.

He put that question to rest when he arrived at the House Financial Services Committee in a suit, but he couldn’t resist adding a quirky touch. Eagle-eyed observers spotted a veritable rat’s nest of laces on his shoes, nothing close to a knot. SBF gleefully responded to Twitter users’ screenshots of the mess with “idk what to say, they came that way :P” while other crypto influencers with hundreds of thousands of followers argued in the comments: “sam i don't know what to say but you can afford to pay someone to dress you,” “He can afford not to give a fuck.”

A quick Google search proves that Bankman-Fried does, in fact, know how to tie his shoes; his sneakers are always properly knotted. So, it’s hard to believe that the dress shoe mishap is anything but continued strategic personal branding.

“He really seems like someone who is very in touch with the psychological possibilities of clothing,” said Tashjian. “And what that can express to people who are looking at you, particularly when you’re under a lot of scrutiny.”

For many observers, that appearance served as a welcome to the (now disgraced) cult of SBF. Membership provides: Youthful exuberance. An up-close look at brilliance. Eccentricity. And most importantly to potential investors like you: allowing you, too, to afford not to give a fuck.

Two of Bankman-Fried’s closest colleagues — FTX co-founder Gary Wang and former CEO of Alameda Research Caroline Ellison — adopted and reflected SBF’s atmospherics as well: Both are under 30, dressed to look even younger and were self-consciously nerdy.

Unfortunately for past believers, the exorbitant returns on investment turned out to be a lie, which naturally calls into question the eccentricity and supposed brilliance. Bankman-Fried and his associates’ boy (and girl) genius schtick turned out to be masking a litany of allegedly fraudulent behavior. His strategy for attracting investors relied heavily on the studied development of his personal quirks. And no matter how much money venture capitalists in Silicon Valley have to throw around, they learn from these sorts of high-profile crashes; next time someone plays a video game during a pitch meeting with Sequoia Capital, they’re more likely to see a boy than a genius.

The death of Bankman-Fried’s company also means the end of his particular kind of influencer aesthetic — a dressed-down look meant to catch eyes and attention. It’s different, certainly, from the turtlenecks of Steve Jobs and Elizabeth Holmes or Adam Neumann parading around in his bare feet, but it’s meant to convey a similar message: I’m different. I’m the future. Come along.

As Tashjian put the argument from SBF’s perspective in particular: “I even have to put aside care towards my clothing and personal appearance in order to dedicate myself to creating this New World Order.”

Tech entrepreneurs are far from the only ones to insist that they — and they alone — know the future. Financial fraudsters dating back to Charles Ponzi have explained away any oddities in their business with a winning smile and a promise that they’re just better at their job than everyone else. That attitude extends to some ambitious people who haven’t committed financial crimes as well. Even Mark Zuckerberg showed up to an early business meeting deliberately late and in pajamas, saying in so many words that he already knows best, that the meeting wasn’t worth his time. (This was due largely to conflict between investors and Zuck collaborator Sean Parker.)

But things have changed. People on the inside say there’s now a little more professionalism in Silicon Valley’s business meetings (even if all the pitches still include promises to change the world for the better).

“I drove through Union Square [in San Francisco] recently … and every corner was full of people in business attire,” said Victoria Hitchcock, a personal stylist and image-maker specializing in Silicon Valley. “I’ve never seen that in my entire life. I’ve seen it in New York, I’ve seen it in Europe, I’ve never seen it here.”

SBF, though, may have been projecting a certain kind of nostalgic image. Early tech founders dressed like they came from the inside of their parents’ garage because many of them did.

“Investors typically are not super savvy in terms of the new, more modern lifestyle that this generation of younger founders has taken on. … Maybe he figured, ‘If I look authentic and hardcore, maybe I did work out of a garage,’” said Hitchcock.

Bankman-Fried was making enough money — and was confident enough in the version of himself he presented to the world — that his image worked. It made him a known, if eccentric, quantity. And yet, “looking authentic” is not the same as being so.

“[Real authenticity] is not rooted in a desire to be authentic,” said a founder in Silicon Valley who ignored investment queries from FTX. “When you see this [desire], you get people like Sam Bankman-Fried and Elizabeth Holmes, who become obsessed with their unique image as their primary asset.”

Novel entrepreneurs with a viable product idea and an ability to lead a team are in short supply, no matter the industry. In Silicon Valley, finding one can be the ticket to an investment worth billions.

“Authenticity is maybe the most important part of a pitch at an early stage company. … Ultimately, they’re investing in the founder,” said the same founder.

Becoming famous, which Bankman-Fried (and Elizabeth Holmes or Adam Neumann) conspicuously pursued, can help influence people to buy an idea or a company. But the hype machine only lasts so long. In the wake of FTX’s collapse, which came amid the Fed raising interest rates, the tech industry getting hit with massive layoffs and investors tightening purse strings, there’s a new style of presentation that’s in vogue, according to Hitchcock.

In a world of tightening purse strings, with less money moving in the industry, experts argue that hucksters will become less common. Gone are the overnight success stories of myopic founders with adolescent trappings who sleep on beanbags. They’ve been replaced by a desire for “adults in the room,” hence the business attire returning to business meetings. Free-wheeling tech influencers are waning. The hottest phrase in California is due diligence.

A successful, large-scale influencer understands the power of fear. In particular, the fear of getting left behind. And in order to convince people that they’re doing something wrong, sometimes you have to swim against the tide.

SBF mastered this. He was careful in the carelessness of his presentation. Where he was less scrupulous in how he ran his business. After billions disappeared in the course of 24 hours when investors rushed to withdraw their money and he could no longer hide that his companies were drowning in debt and he was shifting money back and forth from Alameda to FTX to cover, the New World Order looked a lot less attractive. And the ripple effects, beyond all the money lost, are huge.

The crypto craze has cooled off dramatically — how many cryptocurrency Super Bowl ads will we see this year? Young people proselytizing about how they’ll change the world now look deeply unattractive to investors. Caution has replaced gleeful negligence.

That’s not good for anyone who wants to sell themselves as something new and fresh. For a couple of brief years, people entrusted their money to someone who pretended he couldn’t be bothered to tie his shoes at Congress. They did so partially because they bought into that performance and what it said about his motivations. That age may be ending. Investors aren’t lusting after idiosyncratic entrepreneurs insisting everything will be different in 12 months.

“At first, his approach may draw attention,” said Hitchcock. “But it’s not fun to watch after a while. … If I would have been in meetings with him, I probably would have looked away. I would have closed my eyes.”

----------------------------------------

By: Calder McHugh

Title: Did Sam Bankman-Fried Just End the Era of the Boy Genius?

Sourced From: www.politico.com/news/magazine/2023/02/10/sam-bankman-fried-crypto-image-00081637

Published Date: Fri, 10 Feb 2023 04:30:00 EST