The U.S.-China battle is starting to threaten the fight against climate change.

For the U.S., the crash effort to move away from fossil fuels is colliding with policies meant to wean the nation off its dependence on China for clean energy gear such as solar panels and batteries. And that’s creating headaches for President Joe Biden’s climate agenda that are spilling out across governments and industries — including European countries angry at Washington’s protectionism and U.S. companies facing Republican attacks over their Chinese business ties.

The result is an increasing pile of headaches as the United States confronts two realities: the rapid warming of the planet and Beijing’s dominance of the world’s green energy economy.

For the U.S. and China, the world’s two biggest producers of greenhouse gases, the climate push is becoming enmeshed in the countries’ larger military, technological and economic rivalries. The undertow from that competition is pulling in businesses large and small, from Ford Motor Co. to solar panel installers threatened by a bipartisan clamor for harsher tariffs against Chinese-made gear. State and local governments also risk a political backlash if they work with Chinese companies to build clean-energy factories in the United States.

“It’s just crazy,” said Max Baucus, a former senator and U.S. ambassador in Beijing, about the uptick in sharp political rhetoric casting Chinese ties to U.S. energy projects as a dire threat. “There clearly is some concern, but it’s overblown. It’s uncritical.”

More broadly, animosity from both sides of the Pacific threatens to choke off U.S.-China cooperation on clean energy, advocates for maintaining ties between the two countries say. Those include Biden administration officials trying to revive the climate diplomacy that flourished during the Obama era.

“Climate is an issue of interest that intersects with China’s,” a White House National Security Council spokesperson told POLITICO, “which is why we will continue to work together toward a cleaner energy transition and to combat the climate crisis.” The NSC requested that the person not be named so they could speak candidly about the U.S.-China relationship.

White House officials have been adamant that they want the United States, not China, to dominate the technologies powering the future of clean energy.

But Treasury Secretary Janet Yellen, national security adviser Jake Sullivan and U.S. Trade Representative Katherine Tai all recently sought to downplay the notion that the U.S. is making a strategic decision to “decouple” from the Chinese economy — after more than two decades of building up economic ties.

Beijing blames Washington for the friction and says the fallout could slow the adoption of cleaner energy technology in multiple countries.

“It is not only China that the U.S. is trying to contain and bring down, but also a large number of developing countries,” Mao Ning, a spokesperson for China’s foreign ministry, said at a recent briefing in Beijing.

'An existential struggle'

The great power competition on clean energy could cut multiple ways, according to current and former officials of both countries and experts on the U.S.-China relationship.

Some people have seen it as a cause for optimism, saying it could increase the global supply of batteries, solar panels, wind turbines and other technologies.

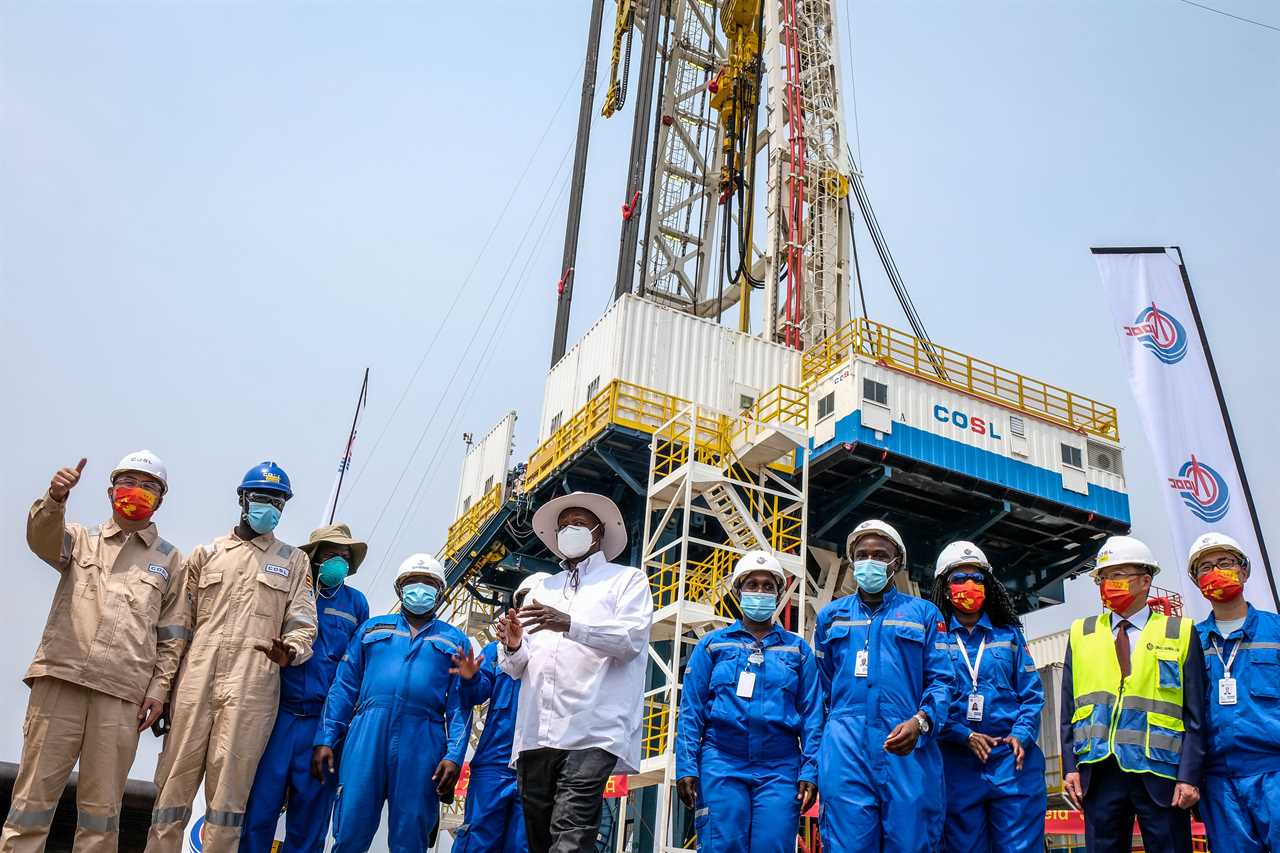

But it could also take entire supply chains out of circulation for parts of the globe, if the U.S., China and their allies divvy up markets and try to box out their rivals. In parts of Africa and Asia, competition between the two superpowers could complicate financing opportunities when countries rely on a mix of U.S.-led bilateral funding and China’s overseas lending for projects to transition away from coal and oil.

Resistance to using Chinese-sourced technologies or minerals in the U.S. could also make it harder to meet Biden’s goal of cutting the nation’s carbon pollution in half by 2030.

“Healthy competition can certainly accelerate the energy transition,” said David Sandalow, a senior official at the Department of Energy during the Obama administration and founder of the U.S.-China program at Columbia University’s Center on Global Energy Policy. “But the breakdown in communication, and the rhetoric that characterizes the relationship right now, is not healthy.”

Trade between the U.S. and China remains lopsided in favor of Chinese imports. The countries saw nearly $700 billion in trade in 2022, including imports of solar panels and battery components, a record-setting figure that has provided a talking point for Republicans attacking Biden’s climate policy.

Rep. Mike Gallagher (R-Wis.), chair of the House Select Committee on the Chinese Communist Party, has declared that Beijing and Washington are locked in “an existential struggle over what life will look like in the 21st century.”

Gallagher links China’s dominance in solar manufacturing to the use of forced labor in Xinjiang province in western China. He dismisses the potential for cooperation. “China is not a partner on the environment,” Gallagher said. “It is the No. 1 threat, globally.”

'Rome doesn't get built in a day'

Republicans aren’t the only ones sharpening their China rhetoric.

Twenty-one Democrats in the House and Senate joined Republicans during the past month in voting to rescind a Biden administration moratorium on tariffs for solar equipment from Malaysia, Thailand, Cambodia and Vietnam, which the Commerce Department has accused of acting as conduits for Chinese products.

The Biden administration had put a two-year pause on the tariffs, responding to pleas from U.S. solar companies that said penalties on Southeast Asian imports would devastate their industry and threaten the president’s climate goals. Biden vetoed the congressional resolution this week, explaining it would “create deep uncertainty for American businesses.”

Sen. Sherrod Brown (D-Ohio), one of the Hill’s most ardent supporters of Biden’s pro-labor agenda, argued against the White House’s position on the tariffs.

“In the end, it’s a simple choice,” he said. “Are you on the side of the Chinese Communist Party, or are you on the side of American workers?”

Brown’s vote also cut against the interests of a solar industry in Ohio that partners with China, a top industry trade group said.

“The solar and storage industry must build more manufacturing capacity in America, and the two-year tariff moratorium provides a bridge for us to do just that,” Abigail Ross Hopper, head of the Solar Energy Industries Association, said in a statement. “Curbing supply at this critical time will hurt American businesses and prevent us from deploying clean, reliable energy in the near-term.”

China dominates the supply of core components for solar panels — polysilicon, solar wafers and solar cells — and the production of some categories of panels, according to data compiled by Bloomberg New Energy Finance. Beijing has also spent the past decade and a half channeling massive amounts of money to build up China’s energy technology companies, skewing markets across the globe.

In turn, the U.S. has made a fundamental shift in its approach to China in recent years by actively seeking to curtail its military power, economic strength and influence over the development of advanced technology. That’s a change from decades in which U.S. policymakers and business groups hoped that trade in areas like computing and energy technology could keep the lines of communication open between the two governments on major issues like climate change.

Now, hypercompetitive U.S.-China relations and protectionist policies risk getting in the way of scaling up green technology manufacturing, said Joanna Lewis, an associate professor at Georgetown University and an expert on China’s energy economy.

“The benefits of being involved with China in the green energy space outweigh the risks, even for the U.S.,” Lewis said.

China and countries close to it in Asia ship most of the world’s solar equipment. “It isn’t entirely by accident that this has all occurred,” said Ethan Zindler, an analyst at BloombergNEF. “Chinese firms have had access to very low-cost or even zero-cost capital, and a lot of push from the central government to scale these industries up.”

Now, after enacting a climate law last year that offers $369 billion in clean energy subsidies, the U.S. is making its own push to create a home-grown industry. “But Rome doesn’t get built in a day,” Zindler said.

Cullen Hendrix, a senior fellow at the Peterson Institute for International Economics, said creating a network of trade relationships outside of China would be more fruitful that pushing China out of the U.S. economy.

“It should not be the U.S. goal to completely de-Chinafy these supply chains,” he said, including the mining and processing of the lithium, cobalt, nickel, graphite and other minerals that go into electric car batteries.

“The idea that you can have a truly made-in-America supply chain for all of these minerals is a fiction,” Hendrix said, adding that “no amount of political will is going to generate deposits where they don't exist.”

Degrees of separation

U.S.-China tensions are producing small temblors on a regular basis.

The Department of Homeland Security last week raided U.S. facilities operated by China's Jinko Solar Holding Co. Ltd., one of the only Chinese solar panel makers to open a factory on U.S. soil. The agency has not provided a reason for its investigation. In Texas, the state Senate last month voted to ban Chinese nationals from owning land. Lawmakers took a similar measure last year in response to a Chinese tycoon’s purchase of 140,000 acres near Laughlin Air Force Base to build a wind farm.

Even major U.S. companies that plan to build clean energy factories at home are getting caught in the China crossfire.

A prime example is Ford, whose plans to build a $3.5 billion electric vehicle battery plant in Michigan have taken criticism from lawmakers including Sen. Marco Rubio of Florida, the top Republican on the Senate Intelligence Committee, and Senate Energy and Natural Resources Chair Joe Manchin (D-W.Va.). They object to Ford’s decision to license technology from China-based Contemporary Amperex Technology Co. Ltd., the world’s largest producer of electric vehicle batteries.

Virginia’s Republican governor, Glenn Youngkin, had rejected an effort to have Ford place the battery plant in his state, citing the deal with CATL. In an interview with Bloomberg in January, Youngkin called the battery-maker “a front for a company that’s controlled by the Chinese Communist Party.”

Ford’s plant is one of a host of projects that stand to benefit from the subsidies in Biden’s climate law, including federal tax breaks for electric vehicles built in North America.

Earlier this month, Rubio urged the Biden administration to investigate a separate deal in which Ford is collaborating with a Chinese company to build a nickel processing plant in Indonesia. (Nickel is a key mineral for electric vehicle batteries.) That arrangement raises concerns about “Ford Motor Company’s possible complicity in human trafficking and forced labor," Rubio wrote to the acting head of U.S. Customs and Border Protection.

A Ford spokesperson rejected Rubio’s accusations at the time, saying: “These assertions are obviously absurd and don’t merit response.” The company said it enforces a code of conduct for its suppliers, including on issues like human rights.

GOP lawmakers are also demanding that the Energy Department terminate a $200 million grant proposed under 2021’s bipartisan infrastructure law to Microvast Holdings Inc., a Texas-based battery technology company that has operations in China. Some Democrats have raised questions about the deal, too. The department has said it’s still vetting those grants.

Microvast executives call those fears misplaced, saying their objective is to help the United States compete and maintain global supply chains.

Boosting U.S. clean energy companies is a prime goal of the 2022 climate law’s Buy American provisions. That has angered European governments whose own exports can’t share in the incentives.

The climate law, known as the Inflation Reduction Act, also includes targets for ensuring that the U.S. or its closest trading partners provide the critical minerals for electric vehicles’ batteries. And it bars the use of battery components from “foreign entities of concern” — namely, China.

But realistically, Chinese companies are going to be involved if the U.S. wants to import certain kinds of battery minerals from places like Indonesia.

“The question is really the degree to which we can usefully separate China — the People’s Republic of China — and then Chinese firms,” said Hendrix of the Peterson Institute.

Sen. Angus King (I-Maine) said lawmakers need to take a case-by-case look at the involvement of Chinese investors and businesses in energy projects.

“I am very concerned about the threat of China on a whole lot of fronts — military, cyber, theft of intellectual property — but I don’t like the knee-jerk reaction to every arrangement,” he said. “I know companies in the U.S. that have Chinese ownership that are very responsible. They invest, they create jobs.”

Manchin, who crafted the climate law’s domestic requirements, said he doesn’t object to U.S. and Chinese companies doing business together. But he said the U.S. can’t allow China to control access to certain critical resources.

“They have dominance in so many areas that never should have happened,” Manchin told POLITICO.

Some states are forging ahead with China-linked energy deals despite potential flak from Washington. Ohio recently announced a joint venture between Chinese panel-maker Longi Solar and Invenergy LLC, a Chicago-based solar developer, and Michigan has embraced the Ford deal with CATL.

“We need to get the politics out of this conversation,” said Michigan Gov. Gretchen Whitmer, a Democrat, at a recent investment conference outside Washington.

A U.S.-China rapprochement

Former U.S. diplomats point to a bigger risk from letting an economic cold war spin out of control: U.S.-China cooperation on climate change would halt.

Just eight years ago, an agreement between then-President Barack Obama and Chinese President Xi Jinping was a crucial prelude to the global negotiations that led to the 2015 Paris climate accord.

Obama and Xi had pledged to cooperate on climate change and push toward binding commitments in Paris — a step that was announced with fanfare and viewed as a major breakthrough ahead of the climate summit. Crucially, the two leaders also pledged to provide aid to help the poorest nations adapt to climate change and build less carbon-intensive economies.

But the U.S. and China haven’t held bilateral climate talks since August, when Beijing froze cooperation in retaliation for former House Speaker Nancy Pelosi’s visit to Taiwan. A slow thaw may be underway — U.S. climate envoy John Kerry said earlier this month that China had invited him back to Beijing to restart discussions.

Broader relations between the two countries began to chill late in Obama’s second term. That trend accelerated under former President Donald Trump, who increased tariffs and trade barriers against China starting in 2018. In return, China raised barriers for some U.S. products.

Under Biden, the U.S. has taken a more targeted approach while pushing against China’s market power in major parts of the economy, including technology. In October, the administration moved to restrict the export to China of advanced semiconductors and chip-making equipment that could benefit Beijing’s military industrial complex.

The Covid-19 pandemic and resulting global supply-chain disruptions also deepened distrust. U.S. concerns about Beijing’s saber-rattling over Taiwan, human rights abuses in Xinjiang and the discovery of a Chinese spy balloon over the American mainland in February only reinforced tensions.

Now is an inflection point on climate because of the importance of the U.S. and China in the deployment of clean energy, said Jonathan Pershing, who was a top U.S. climate negotiator in 2015 and at the start of the Biden administration. “It could, in fact, be the case that we could lose the confidence on both sides to allow us to move forward,” Pershing said. “This is a moment which would require engagement, not walking things back.”

China’s overture to Kerry could mark a shift back toward dialogue, said Li Shuo, a global policy adviser at Greenpeace in East Asia.

It could lead to the countries engaging in areas that don’t stir national security concerns. For example, the U.S. and China could jointly enforce human rights standards in developing countries where extraction of battery minerals is big business, such as the Democratic Republic of the Congo.

'Countries do not want to choose'

Emerging economies need the costs of green technology to come down quickly, and competition between the U.S. and China could prevent prices from falling faster.

“Countries do not want to choose. They want to be able to work with multiple partners to meet their infrastructure financing needs,” said Cecilia Han Springer, assistant director of the Global China Initiative at Boston University.

The unraveling of relations has also troubled some U.S. allies and left an opening for China to woo them.

French President Emmanuel Macron received a particularly warm welcome when he visited China in March to shore up relations. European Commission President Ursula von der Leyen, who played a more muted role during the same trip with Macron, has called for a “de-risking” rather than a more dramatic split that upends the world economy.

China, meanwhile, has been striking deals in the Middle East. Sinopec, China’s state-owned oil company, is partnering with Qatar on a liquefied natural gas project. And China has poured money into ports and energy infrastructure near the Strait of Hormuz, a critical chokepoint for global oil shipments.

Beijing has spent decades investing in countries in Africa and Latin America where the U.S. has had less of a presence due to perceived political risks.

Kate Logan, associate director of climate at the Asia Society Policy Institute, said U.S. policies that attempt to address climate change while countering China have been divorced from the nations’ outreach and investment in the developing world.

“If we're so focused on countering China in a way that doesn't necessarily look at the fastest ways to shore up manufacturing of all the technologies and bring them to cost as fast as possible, that's bad for developing economies around the world,” she said.

Instead, the White House is pushing for the U.S. to forge closer ties with allies in the Indo-Pacific region to secure minerals for batteries and other energy technology and as manufacturing bases outside of China, a concept known as “friendshoring.” Rather than looking to claw back China’s control over important resources, the United States would focus on widening its supply chains around the world, said Hendrix of the Peterson Institute.

Mari Pangestu, a former trade minister of Indonesia, agreed that a broader U.S.-China economic split amid rising security tensions would penalize developing nations.

“The ultimate objective is a green transition that developing countries can afford,” Pangestu said.

Josh Siegel contributed to this report.

----------------------------------------

By: Sara Schonhardt and Phelim Kine

Title: ‘It’s just crazy’: How the U.S.-China energy race imperils the climate fight

Sourced From: www.politico.com/news/2023/05/18/us-china-energy-fossil-fuels-00097207

Published Date: Thu, 18 May 2023 03:30:00 EST