US prices are up. What’s less clear is if it’s a temporary or a longer-term shift.

This is an excerpt from The Weeds newsletter. To subscribe for a weekly dive into policy and its effects on people, click here.

If you’ve been watching the news lately, you probably have a good sense that inflation is going up — that, in other words, things are getting a bit more expensive.

Only it’s a little more nuanced than that.

It’s true that the Consumer Price Index (CPI) rose 5.4 percent in the 12 months ending in September. That included a more than 42 percent increase in the price of gasoline, a more than 24 percent increase in used cars and trucks, and a nearly 20 percent increase in hotels and motels.

But many economists say the CPI isn’t the best indicator of inflation — the Federal Reserve, for one, generally relies on a different standard.

There’s also reason to believe that comparing current prices to last year’s isn’t a good idea. There’s a very good reason — the coronavirus — that hotel prices, for example, were likely depressed last year, so one should expect such prices to rise now.

There are also things that traditional measures of inflation don’t fully pick up — what some economists call “shadow inflation.” Essentially, higher prices on goods and services can also lead businesses to ration or reduce the quality of their own goods and services, instead of hiking their own prices. If you’ve been to a hotel recently, you may have witnessed this, as many of these businesses are no longer doing daily room cleanings or room service. Or you may have noticed it, as I certainly have, in the struggle to get a PlayStation 5.

So what’s going on? In short, it’s supply and demand.

During the Covid-19 pandemic, many businesses cut back services and orders — on, say, semiconductor chips used for cars and PlayStations — and that has led to some supply shortfalls that linger today.

At the same time, US demand for goods is skyrocketing: Inflation-adjusted retail spending is up 14 percent over the past two years, the New York Times reported. That’s in part a result of unleashed pent-up demand (and savings) as the country returns to a pre-pandemic normal, buoyed by the infusions of money the federal government sent out in response to the Covid-19 recession.

There’s a big question of where this all leads now: Is this temporary? Will this all fix itself as the American economy — and, really, society as a whole — recovers from the pandemic? Or is this part of a “regime shift,” in which higher inflation will be baked into the system for some time?

The Federal Reserve, for its part, seems to believe the current period is transitory. But it’s also acknowledged that may not be the case, promising to remain vigilant in the months ahead.

The honest answer, then, is that we don’t know if the current inflation situation is temporary or something longer-term.

Still, it’s having an impact right now on policy discussions. Sen. Joe Manchin (D-WV) has argued Democrats’ reconciliation bill, once estimated at $3.5 trillion, should be scaled back to avoid fueling even more demand and therefore more inflation.

But there are also ways more spending could help bring down inflation. For example: Oil and gas have been major drivers of inflation over the past few decades. So if lawmakers, as they plan to in the reconciliation bill, make the American economy less reliant on oil and gas, that could lead to fewer periods of high inflation over time — even if it means pumping more money into the economy right now.

So, yes, it’s complicated.

It’s not the most satisfying conclusion in the world, but it harks back to last week’s newsletter on our collective ignorance: Sometimes, we just don’t know enough about something to draw hard conclusions — and it requires a little humility and flexibility to get by.

Paper of the week: Vaccine lotteries likely weren’t effective

A new research letter in JAMA Health Forum suggests that lottery prizes for Covid-19 vaccines may not have moved the needle on vaccination rates.

As the vaccine rollout slowed earlier this year, Ohio was among the first states to announce that it will offer a $1 million prize, through a statewide lottery, to five vaccinated adults. The early data was promising, suggesting the scheme boosted vaccination rates. So many states followed suit with their own lotteries.

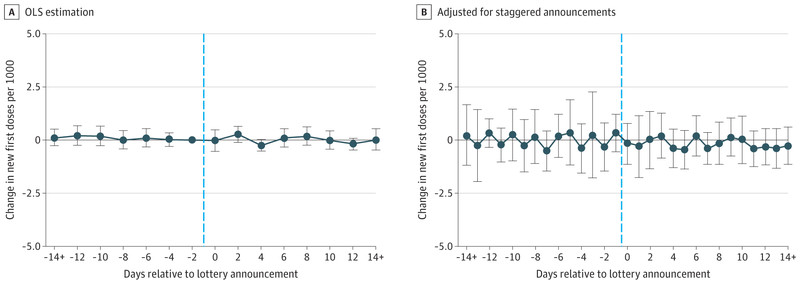

But when researchers Dhaval Dave, Andrew Friedson, Benjamin Hansen, and Joseph Sabia ran the numbers, the results were disappointing — finding no evidence of even small associations between vaccine uptake and the lottery programs.

JAMA Health Forum

The researchers caution that the findings don’t mean no incentives worked; this is only about the lotteries. And the study is largely correlational, so the results shouldn’t be taken as the final word on the matter.

I would also add that this doesn’t mean the lotteries weren’t worth doing. As I argued after Ohio’s first drawing, these kinds of experiments are exactly what we needed — and still need — in the push to get everyone vaccinated. From a practical standpoint, we wouldn’t know if lotteries worked if we hadn’t tried them.

It would have been much better, of course, if it turned out that the lotteries were a smashing success. But, due to some policymakers’ willingness to experiment, at least we now know for future reference that they’re likely not a good way to get more people vaccinated.

----------------------------------------

By: German Lopez

Title: The recent rise in inflation, explained in 600 words

Sourced From: www.vox.com/the-weeds/2021/10/22/22740372/inflation-increase-price-hike

Published Date: Fri, 22 Oct 2021 17:00:00 +0000

Did you miss our previous article...

https://consumernewsnetwork.com/politics-us/giuliani-associate-is-convicted-of-campaign-finance-charges