Democrats are struggling with a huge problem that could sink them at the ballot box: They may end up looking more sympathetic to rich people than Republicans.

After spending several election cycles campaigning against the GOP’s tax cuts as a boon for the wealthy, House Democrats are on the verge of passing a massive tax break for high-income earners — raising a cap on local and state tax deductions that primarily affects high-cost states. Though it’s good politics for many coastal-area members to include that tax relief in President Joe Biden’s social spending and climate bill, it’s a move that Democrats say threatens to become a national liability ahead of next year’s midterms.

With Democrats already lagging behind Republicans in national polls, many in the party say anchoring themselves to this issue is the last thing they should do. Sen. Jon Tester (D-Mont.) said he’d “just as soon have it out. Not a big fan because I think it gives tax breaks to the wrong people: Rich people.”

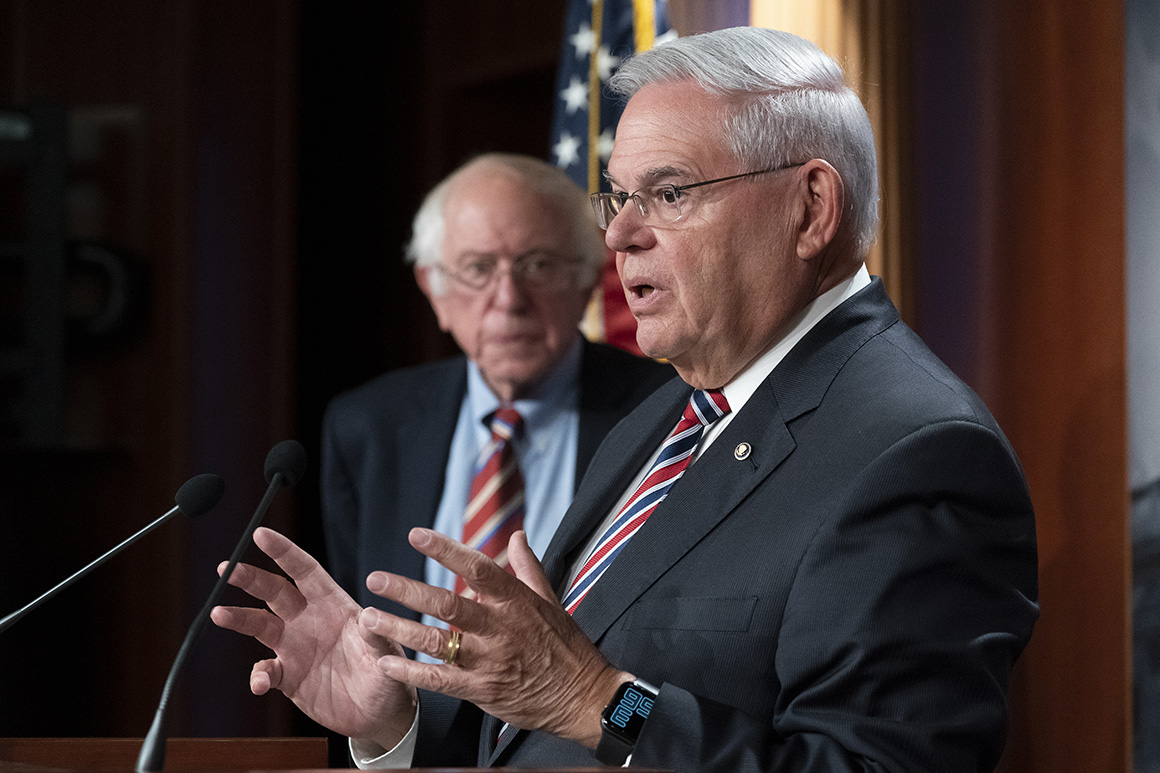

“You can’t be a political party that talks about demanding the wealthy pay their fair share of taxes and then end up with a bill that gives large tax breaks to many millionaires,” said Sen. Bernie Sanders (I-Vt.). “You can’t do that. The hypocrisy is too strong. It’s bad policy, it’s bad politics.”

Democrats careened into this mess because of promises to their constituents four years ago, when Republicans restricted the use of state and local tax deductions that are particularly valuable in high-cost blue states to help finance their broader tax cuts bill. Backers of the effort include Senate Majority Leader Chuck Schumer and an array of Democrats in New York, New Jersey and California who campaigned on reversing those policies, even though the message cuts against the national party’s progressive tax aspirations.

“It’s intent was to penalize blue states — I’m not going to let them get away with that,” said Rep. Gregory Meeks (D-N.Y.). “I look at my homeowners in my district and how they’ve been devastated as a result of a $10,000 SALT cap, it hurts them in a very big way.”

Nonetheless, the episode exposes Democrats to damaging attacks. One of the largest components of their bill to expand the social safety net is merely a tax cut for the wealthy — a potent political charge next year in key House and Senate battlegrounds where Republicans already have an advantage.

Raising the cap on SALT deductions is clearly not top of mind for vulnerable incumbent Democrats: Both Sens. Raphael Warnock of Georgia and Mark Kelly of Arizona said in interviews they are instead squarely focused on middle-class tax relief. Yet due to the party’s minuscule majorities, almost the entire Democratic Party will have to support the social spending bill to pass it.

That could force Democrats in battlegrounds like Arizona, Georgia and Pennsylvania to back priorities of Northeastern and California Democrats’ that aren’t necessarily popular in contested states and districts.

Rep. Jared Golden (D-Maine), one of the most vulnerable House Democrats next year, blasted the SALT plan in a series of tweets Wednesday night, saying it seemed like “Republicans were in charge.”

“The fact that more people and orgs on the Democratic side aren’t up in arms about this is wild,” he wrote.

Senior Democrats are acutely aware of the fallout that could accompany codifying the tax break, and many privately worry the issue could do as much, if not more, electoral damage than Democrats’ largely symbolic effort to reform immigration in the social spending bill. But with just a three-vote margin in the House, Democratic leaders can’t afford to lose the support of the handful of Democrats demanding the tax relief.

Still, the political messaging prospects makes Republicans almost giddy.

“It’s foolish … if you look at the amount of money they are going to give to rich people, it’s staggering,” said National Republican Senatorial Committee Chair Rick Scott (R-Fla.). “I’m going to make sure that in all of our states that everybody knows what [Democrats] are doing.”

Led by Sanders and Sen. Bob Menendez (D-N.J.), Senate Democrats are already moving to limit millionaires from saving thousands of dollars per year on taxes. Sanders wants to begin phasing out the relief for families who make $400,000 per year, though even that policy would still inordinately tilt relief to families making $200,000 or more.

House Democrats say they are discussing the proposal with their Senate counterparts but many are not keen on Sanders’ idea. They don’t expect the current language to change before the bill leaves the House later this week. That means House Democrats running for the Senate, such as Reps. Val Demings of Florida, Conor Lamb of Pennsylvania and Tim Ryan of Ohio, may vote for a politically toxic tax proposal that could change altogether in the Senate.

Rep. Tom Malinowski (D-N.J.) said he prefers the House language because “we know exactly what it’ll do” but conceded the Senate may change the House’s work.

“We're actually trying to achieve the very same thing and the principles guiding us are exactly the same,” he said.

Many senators see their proposal as an improvement to what the House is considering. The lower chamber's version would raise the cap on deductions from $10,000 to $80,000 and give an average of a $25,000 tax cut to a hypothetical D.C. family making $1 million a year, according to the Committee for a Responsible Budget. Most millionaires would see a tax cut under that proposal, according to the Tax Policy Center.

“I’m not worried about the perception that we’re doing too much for wealthy people. I’m worried that we may do too much for wealthy people. It’s the reality that troubles me,” said Sen. Elizabeth Warren (D-Mass.). “I’m not here to help those at the top.”

Democrats have already faced several setbacks on taxes, namely Sen. Kyrsten Sinema (D-Ariz.) opposing tax rate increases on corporations and the wealthy. Instead, Democrats have settled on a surtax that would hit people making $10 million or more, but the House’s SALT proposal nonetheless threatens to reshape the contours of what Democrats are trying to achieve. What’s more, many members of Congress are wealthy themselves and could benefit personally from lifting the cap.

House Democrats, meanwhile, maintain they had to structure the SALT proposal the way they did because Sinema nixed their major offsets by opposing tax increases on the wealthy and businesses.

These days, Senate Finance Chair Ron Wyden (D-Ore.) says Democrats are approaching him worried about the hits they are taking from Republicans. He wants to answer that with a tax on billionaire’s assets, which so far has not gained enough support to make it into the bill.

“In the last few days you have seen Republicans saying that Democrats are being softer on millionaires than they were in 2017,” Wyden said. “They’re not saying it, you know, once. They are pounding that message.”

But other Democrats say the real problem is that some in their own party, such as liberal Rep. Alexandria Ocasio-Cortez (D-N.Y.), are outspoken against the tax relief plan, diluting the party’s message that this isn’t a tax cut for the wealthy and giving Republicans an even more potent political weapon.

“There are competing messages that come from within our own caucus over the issue,” said House Ways and Means Committee Chair Richard Neal (D-Mass.). “We have to address that to get this bill over the goal line.”

Bernie Becker contributed to this report.

----------------------------------------

By: Burgess Everett and Heather Caygle

Title: Dems agonize over tax cuts for rich: 'Bad policy, bad politics'

Sourced From: www.politico.com/news/2021/11/18/democrats-agonize-tax-cuts-rich-522859

Published Date: Thu, 18 Nov 2021 04:30:20 EST

Did you miss our previous article...

https://consumernewsnetwork.com/politics-us/is-a-brain-a-telegraph-telephone-or-computer-all-of-the-above