Democrats’ bid to extend the child tax credit is stuck in the mud, and that is raising a politically touchy question for lawmakers: Can they still support tax cuts for businesses?

Some lawmakers think it’s possible to walk that line, and want to use a bill before Congress aimed at boosting competitiveness with China to help tech companies reduce their tax bills.

But some progressives are aghast at the prospect of passing what would be a major tax cut for corporations when the heart of their “reconciliation” agenda is going nowhere fast.

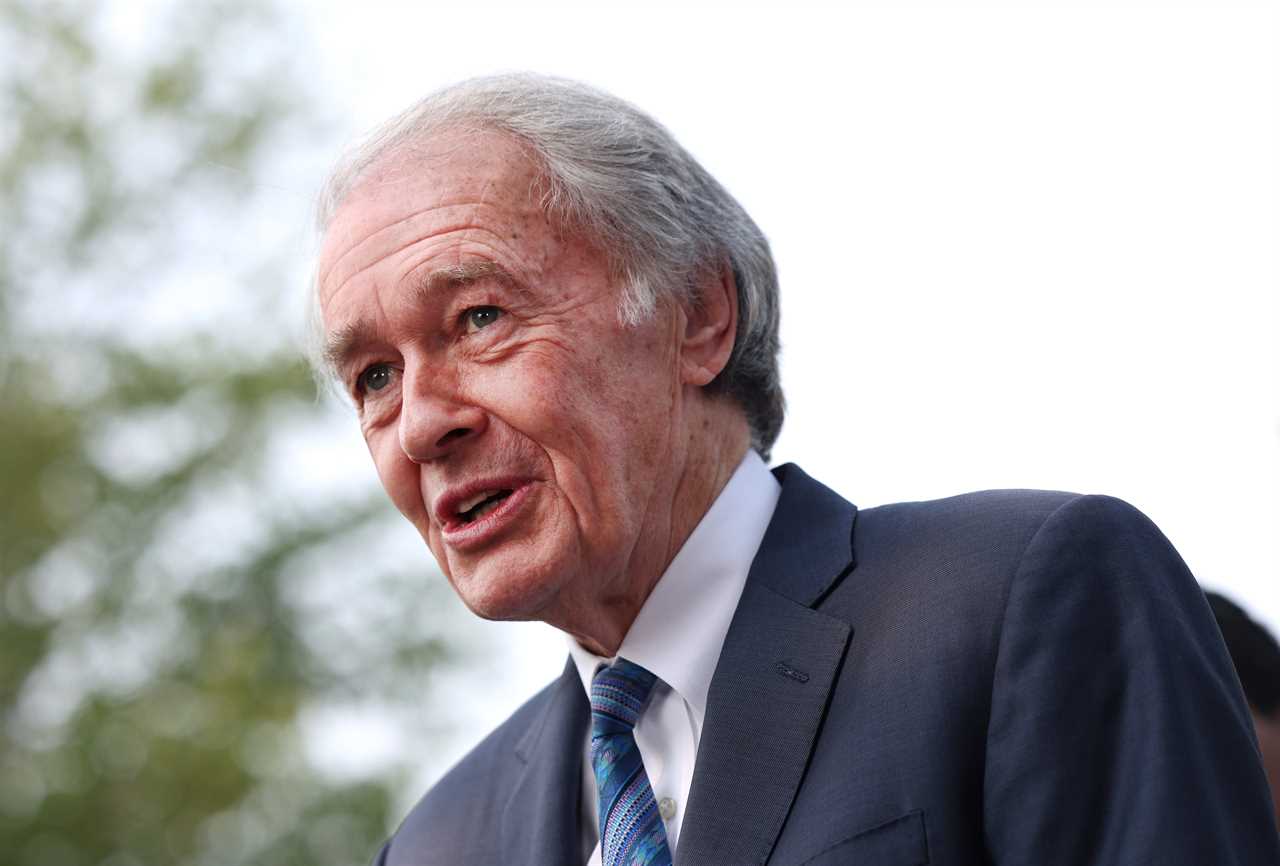

“It’s an insult to working people,” said Sen. Ed Markey (D-Mass.). “No tax cuts for corporations before we get tax cuts for working and middle class families.”

The brewing fight shows how Democrats’ reconciliation plans, firmly lodged in legislative limbo, continue to loom on Capitol Hill, shadowing and shaping the debate over even seemingly unrelated legislation with tax implications.

Democrats’ failure to extend their monthly child payment program — not to mention raise taxes on big companies — has left some wary of helping businesses, including on relatively uncontroversial issues.

Democrats actually supported the proposal in question — easing new restrictions that make it harder for tech companies to deduct their research expenses — as part of their reconciliation plan last year, although it attracted little notice.

But some say that was different because of the context: It was a package deal. Yes, companies got relief on the research write-offs but they would have also been subject to stiff increases in other taxes, and the plan included an extension of the child credit and other goodies for low- and middle-income people.

It’s a very different matter, some say, to now strip out the corporate benefit, pass it and leave the rest of Democrats’ plans hanging.

“There is a stark comparison being made [between helping families and businesses] which I think muddies the political waters,” said Andrew Grossman, a top Democratic tax aide at a recent conference sponsored by the DC Bar Association.

The issue is confronting lawmakers as they try to work out their differences on a bill designed to strengthen U.S. competition with China through various measures, such as promoting the domestic semiconductor industry. Lawmakers kicked off a rare conference committee late last week to work out differences between the House and Senate.

The bill appears to have a clear path to President Joe Biden’s desk, and that has the business community pressing lawmakers to use the opportunity to fix an issue Republicans created as part of their 2017 tax cuts.

For decades, companies had been allowed to immediately deduct the cost of their research expenditures.

To help defray the cost of their tax cuts, Republicans repealed those provisions and required businesses to instead spread those deductions over five years. The move was widely seen as a budget gimmick because the research provisions are among the most popular business tax breaks in the code.

Though the plan was approved as part of the 2017 Tax Cuts and Jobs Act, the new rules didn’t take effect until this January, to the howls of many companies. Northrup Grumman told investors last month that the provisions would cost it $1 billion this year alone.

Many Democrats want to address the issue, with more than 40 in the Senate backing a nonbinding amendment by Sen. Maggie Hassan (D-N.H.) calling on lawmakers to deal with it on the semiconductor bill.

“There is overwhelming support for the R&D tax incentive,” she said. “This is one important way to help power our economy, outcompete countries like China, and keep the U.S. at the forefront of innovation.”

Twenty-nine House Democrats, along with 40 Republicans, signed a recent letter urging party leaders to fix the issue.

Some also hope to add other tax provisions to the measure, including a special new tax break to subsidize semiconductor production though that appears less likely.

It’s unclear how party leaders intend to handle the dispute.

They could decide not to include any tax issues in the China bill, figuring that’s too much of a can of worms. Some lawmakers have already raised concerns that inserting a tax title in the legislation could slow down its passage. Congress has not passed any tax legislation this year, and if party leaders allow some tax provisions, they could unleash pent-up demands from rank-and-file lawmakers to include many others as well.

Though Democrats have thin majorities in the House and Senate, it’s possible they won’t need progressives’ votes and can ignore their complaints — though that depends on what Republicans do.

Republicans could make up the difference in votes, though they are divided over the China measure, including whether it should include any tax provisions.

And some pushing the R&D provisions have begun quietly strategizing about how they might address progressives’ concerns about not having something to offer average voters.

It’s unrealistic to think lawmakers could pair the R&D provision with their long-sought expansion of the child credit, said one former top Senate Democratic aide, not least because of West Virginia Democratic Sen. Joe Manchin’s opposition. The child credit proposal is also far bigger than the research fix.

But perhaps lawmakers could twin that with smaller expansions of family-friendly tax breaks, like the Earned Income Tax Credit.

“Maybe it’s not the child tax credit but are there other family-related tax provisions that don’t cost $100 billion per year that might be a more even trade,” the former aide said, speaking on condition of anonymity.

“People are thinking about whether there are more balanced trades where you’d take some of the venom out of the argument that we’re not doing anything for families.”

----------------------------------------

By: Brian Faler

Title: Democrats torn on corporate tax cut as child tax credit languishes

Sourced From: www.politico.com/news/2022/05/18/democrats-tax-breaks-stalemate-00032666

Published Date: Wed, 18 May 2022 03:30:00 EST

Did you miss our previous article...

https://consumernewsnetwork.com/politics-us/prosecutor-lawyer-lied-to-fbi-on-behalf-of-clinton-2016-campaign