Madisen Williams drives a 2008 Hyundai with over 100,000 miles on it and a leaky hose.

A 33-year-old mother of two, the car allows her to move around Los Angeles to teach private youth dance lessons after Covid-19 forced schools to go remote. And when her next-door neighbor was murdered, the assurance of having a car convinced her to find a safer neighborhood — one without convenient public transportation — to raise her two kids.

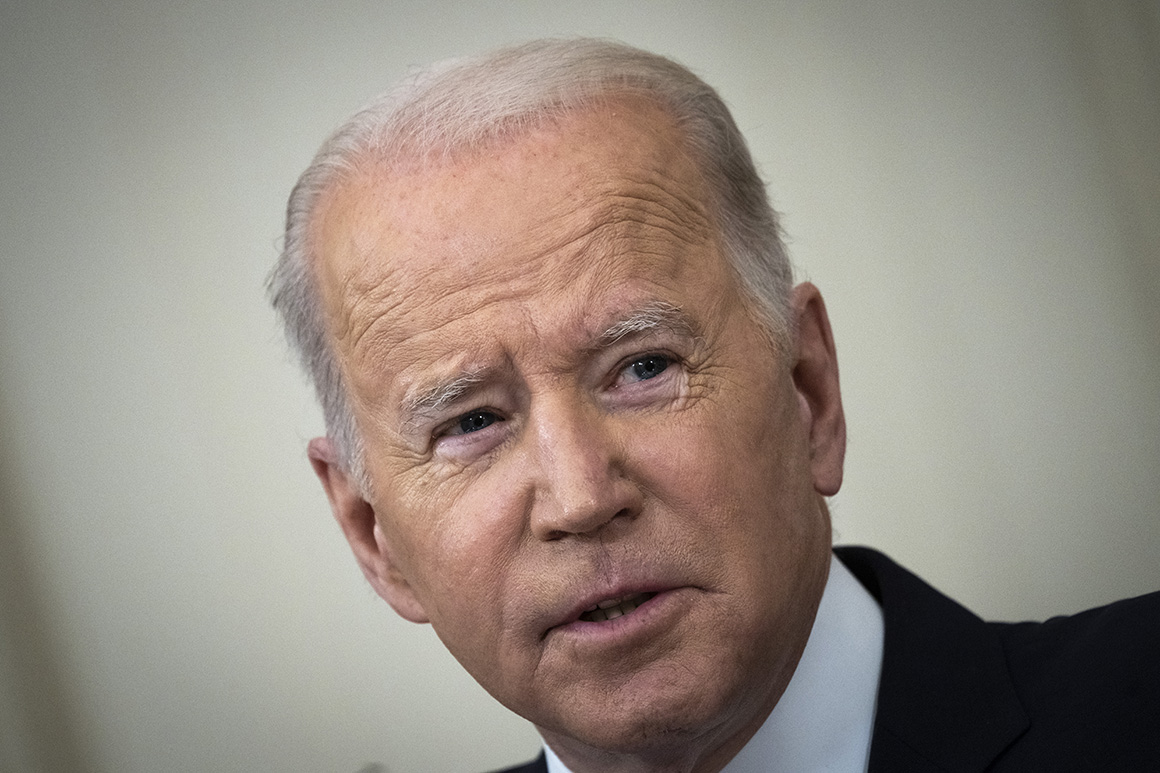

As the car broke down in recent months, Williams leaned on the extra $500-a-month in her bank account that had come courtesy of President Joe Biden’s signature domestic policy to pay for repairs. It may not have been the central purpose of the policy, but it was a lifeline.

“It was perfect,” said Williams of the extended child tax credit, which made even families with the lowest incomes eligible for monthly payments that could total up to $3,600. “It was helping with fixing things.”

The payments Williams and millions of other families leaned on ended in December, the victim of a legislative expiration date and a Democratic party deadlocked over whether Biden’s agenda had gone too big, too fast. Those who had come to rely on the money for everyday tasks, future planning and to cover the rising costs of groceries, are confounded that congressional Democrats let this happen. The individuals interviewed for this article said they'd voted for Biden. Some suggested the process had soured them on politics entirely.

“I was thinking, this has helped so many people it would be political suicide to oppose something like this,” said Jessica Morrison, a Pennsylvania mother of two who had previously advocated alongside Democratic lawmakers for expanding the tax credit. “It’s totally upsetting.”

Lawmakers are currently scrambling to try to find a way to extend the expanded child tax credit, with the Biden administration stressing that it remains a priority. But there is no indication that an agreement is coming soon, if at all. And, in the interim, those who leaned on the policy to navigate the pandemic and lift their children out of poverty are struggling to adjust both their perceptions of political leaders and the day-to-day chaos of their own lives.

Recently, Williams’ car broke down in the middle of the street and wouldn’t start up again. The repair costs ran into the thousands, leaving her with no choice but to junk the car. She fears she won’t be able to keep teaching those private dance lessons. She also worries it will complicate the first steady job offer she's gotten in months, because commuting one-way by bus would take three hours.

“When I heard about all the payments and the stuff they were trying to do for us, I was ecstatic because it meant at least they’re listening to somebody,” said Williams, as she grappled with the loss of that extra aid and the prospect it might never be restored. “But there are still so many factors they don’t understand.”

Less than a year removed from shepherding a historic expansion of the nation’s safety net that evoked comparisons to Franklin D. Roosevelt’s New Deal, Biden’s efforts to cement that legacy is at risk. Inflation fears, deficit concerns and the political realities of a 50-50 Senate have upended the White House’s hopes of passing the Build Back Better agenda and, with it, the continuation of the expanded child tax credit.

The program was supposed to have sold itself. It was passed as part of Biden’s Covid-relief package in the spring of 2021 and, almost immediately, began paying policy dividends. Early analyses showed most families put the payments toward buying food and clothing and paying essential bills. More than two in five recipients seized the opportunity to pay off debt. One Columbia University estimate credits the program for driving a nearly 30 percent reduction in child poverty by November — just four months after funds started going out.

“That’s a really big deal,” said Kristin Butcher, director of the Brookings Institution’s Center on Children and Families. “It’s hard to imagine a similar confluence of on-the-ground evidence that shows this seems to be having an immediate impact with a lot of longer-term evidence that it really matters.”

After some negotiation, congressional Democrats settled on including a year-long extension of the extended child tax credit as part of the BBB bill. But the party struggled to solve their internal divisions over the broader proposal. And Sen. Joe Manchin (D-W.Va.) questioned the cost and long-term implications of the extended child tax credit specifically, while floating the idea of tacking on work requirements and implementing a lower income eligibility cap. With no agreement reached, the last of the payments were made on Dec. 15 and the program effectively expired.

Among those who benefited from the program, the enthusiasm they once felt for a White House that seemed refreshingly attuned to their needs has curdled into a sentiment increasingly familiar among Democratic voters: disillusionment.

“When [the payments] ended, I was in a bad mood for like three days, because that money was so helpful to us,” said Morrison. “I can’t even say it’s just Republicans. It’s definitely my own party, and I don’t see anything changing in the near future.”

Like many recipients, Morrison used her $550 a month to help with various expenses, from the mortgage to paying off credit card debt and dealing with unexpected emergencies. The flexibility to use that money for a range of financial needs is what set the child tax credit expansion apart from other safety net programs, economists said, fueling measureable drops in child poverty and food insecurity.

"To be able to just buy the basic necessities required to survive anywhere," said Sharon Lungo, a single mother in Oakland, Calif., whose freelance work slowed during the pandemic. She had been receiving a $300-a-month payment under the program. "It means having food security. It means house security."

Despite the dismay among those who were relying on the extended child tax credit and no longer are receiving it, the White House has signaled that it is ready to jettison the proposal as it moves a pared-down version of its BBB agenda. Biden earlier this month went as far as allowing he’s “not sure” the tax credit can be included in the revised social spending legislation Democrats are still trying to pass.

It was an admission that recipients across the nation said they interpreted as the White House effectively giving up on the policy — and bowing to pressure to “get back to normal” despite a still-raging pandemic and rising costs.

“He was the moderate guy, and what we got was moderate to little change,” said Karla Prater, a 30-year-old project manager who used the payments to buy essentials like diapers for her toddler, while tucking any leftover amount into a college fund. “It feels like we’re in an impossible situation. Unless you have family wealth, you can’t really move forward.”

On Wednesday, a handful of Democratic senators sent a letter to the White House urging Biden to prioritize extending the tax credit, calling it “a signature domestic policy achievement of this administration.” But their demands seem all but certain to run into the same hurdles as before, mainly the absence of Manchin’s support. The other avenues are not promising either. Sen. Mitt Romney (R-Utah) has pitched an alternative proposal that would pay out $3,000 per child — and $4,200 for those under the age of five — in monthly installments. But it would also involve revamping other child poverty programs, and has yet to win any support from fellow Republicans.

A White House official insisted that Biden is still committed to reviving the tax credit, touting it as critical to fighting child poverty and providing support amid the pandemic. But the official declined to lay out any strategy for winning the votes needed to pass it into law. Some Democrats also argue that Republicans are primed to shoulder the blame for any fallout, contending that Biden need only be more aggressive in publicly faulting the GOP for their united opposition to his Build Back Better agenda.

Yet even among voters who recognize Republicans’ role in the stalemate, there remains plenty of disappointment with a Democratic Party that holds full control of Washington and is still falling well short of its stated ambitions.

“It’s reinforcing an incorrect meme that started out that the Democrats don’t get things done — [they] don’t get things done that deliver on our kitchen table,” said Celinda Lake, a Democratic strategist and one of the lead pollsters for Biden's 2020 campaign. “The public is sick of process. They could care less about process.”

Perhaps more ominous for Democrats’ prospects are the odds that the poverty and food security gains the party locked in become undone later this year, as families struggling with the same pandemic begin feeling the full absence of the extended child tax credit.

“People who are using this money to purchase nutritious food, they will either begin taking on more debt or we will see food insecurity rise,” said Elaine Maag, a senior fellow at the Urban Institute’s Urban-Brookings Tax Policy Center. “It sort of shows having people live in poverty is a policy choice.”

For Williams, the Los Angeles mother of two, those effects are already taking hold. A native of the area, she’s been on her own since age 16, bouncing between homelessness and youth shelters as a teenager before finding her footing — only to then endure a failed business venture and a ruinous divorce. But her dance company had shown promise, with deals to run programs for kids in a few schools and parks. Even after the pandemic shut those down, Williams had managed to keep things running, albeit on a shoestring budget.

Now, the halting of the child tax credit payments means no spare cash for a new car, which means no easy way to get to the job she’d hoped would provide a steady paycheck, and no clear idea of what new hardships might lay ahead.

“It sucks that if you have no money, you can’t make money,” Williams said. “I went through all this stuff to try to climb up. And then well, dang, I’m only one step away from being homeless again.”

Aaron Lorenzo contributed to this report.

----------------------------------------

By: Adam Cancryn

Title: Biden’s signature legislation expired. Recipients are wondering: WTF happened?

Sourced From: www.politico.com/news/2022/01/27/bidens-signature-legislation-child-tax-credit-00002560

Published Date: Thu, 27 Jan 2022 04:30:00 EST